Cryptonovae token: What It Is, Why It Matters, and What Others Are Saying

When you hear Cryptonovae token, a little-known blockchain-based digital asset with no clear team, roadmap, or trading volume. Also known as CNV, it’s one of hundreds of tokens that pop up on decentralized exchanges, promise big things, then vanish. Most of these tokens don’t survive six months. They’re built on hype, not utility. And Cryptonovae token? It fits the pattern.

It’s not alone. Look at Papu Token (PAPU), a meme coin on Ethereum with near-zero value and no community, or Karatgold Coin (KBC), marketed as gold-backed but now worth less than 1% of its peak. These aren’t investments—they’re digital ghosts. Same with Cryptomeda (TECH), a gaming token that stopped development in 2022 and now trades for pennies. Cryptonovae token lives in this same graveyard. No team, no updates, no real use case. Just a ticker symbol and a website that doesn’t load properly.

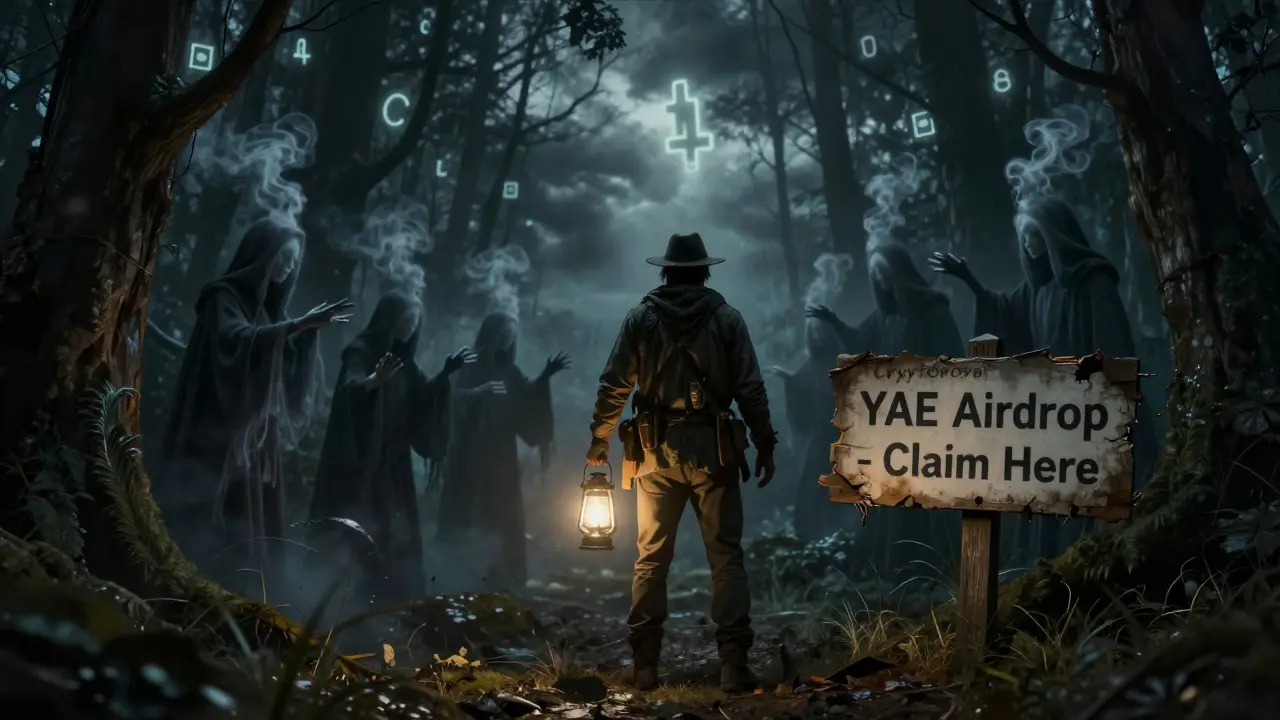

What’s worse? These tokens often get buried under fake airdrops and bot-driven volume. You’ll see price spikes on DEXs like AuraSwap, a low-liquidity exchange with almost no users, but it’s all smoke. Real trading volume? Barely there. Gas fees to buy it? Higher than the token’s worth. And if you try to sell? Good luck finding a buyer. That’s the reality for most tokens like Cryptonovae token.

But here’s the thing: you’re not alone if you’ve wondered if it’s worth a look. People chase these because they see a 10x tweet or a Discord group full of bots. They forget: if no one’s building anything, if no one’s using it, and if the devs are silent—then it’s not a project. It’s a gamble with no odds.

Below, you’ll find real reviews of similar tokens. Not fluff. Not hype. Just facts: who tried it, what happened, and why most of these tokens end up worthless. Some were scams. Others were just badly planned. A few had potential but lost momentum. You’ll see what to avoid—and what to look for instead.