YAE Token: What It Is, Why It Matters, and What You Need to Know

When you hear YAE token, a cryptocurrency token with minimal public documentation and no clear team or roadmap. Also known as YAE, it appears in a handful of obscure wallet lists and low-traffic exchanges—but nowhere near the radar of major crypto platforms. Unlike tokens backed by real apps, teams, or use cases, YAE doesn’t have a website, whitepaper, or active community. That doesn’t mean it’s fake—but it does mean you’re buying into pure speculation, not value.

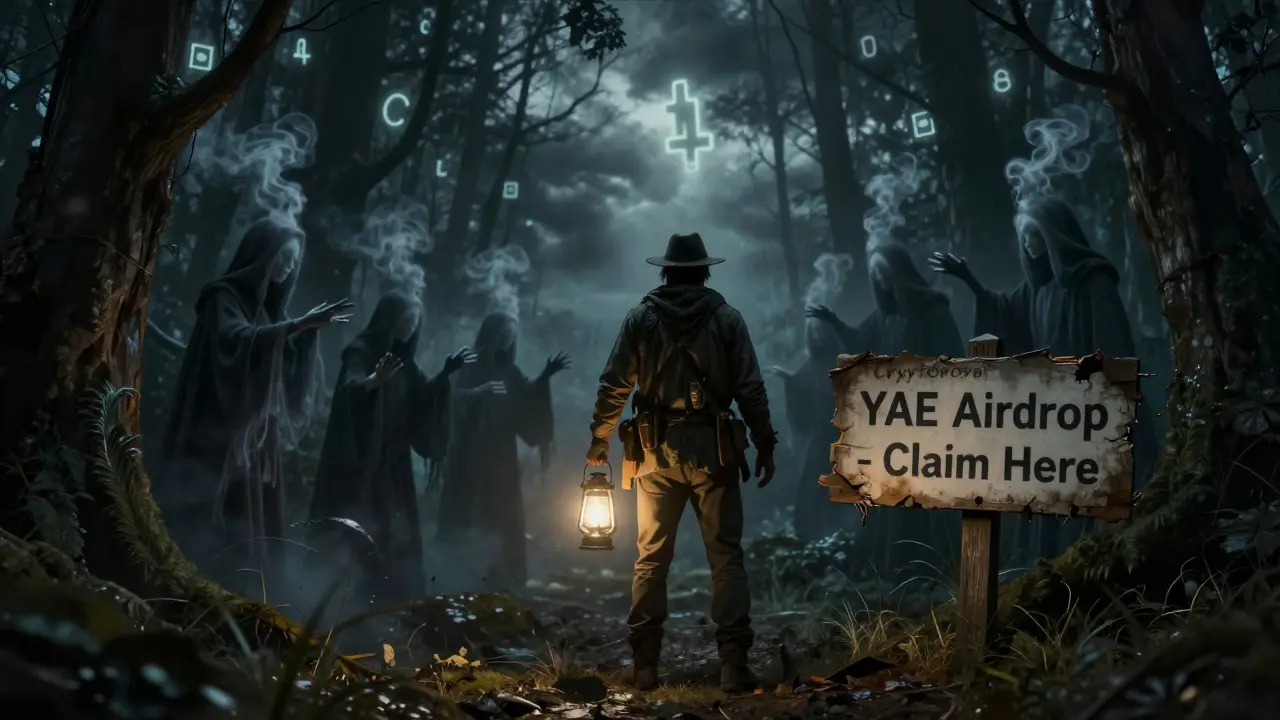

Most tokens like YAE show up in the same places as other forgotten projects: decentralized exchanges with zero liquidity, airdrop lists from defunct campaigns, or wallet snapshots from abandoned testnets. You’ll find it mentioned alongside tokens like Papu Token (PAPU), a meme coin with no utility and near-zero trading volume, or Karatgold Coin (KBC), a gold-backed crypto that collapsed after regulatory warnings. These aren’t investments—they’re digital ghosts. And if you’re seeing YAE promoted on Telegram or Twitter with promises of quick gains, it’s almost certainly a pump-and-dump scheme.

Tokenomics for YAE? No one’s publishing supply data. No one’s tracking holders. No one’s reporting on its price movements beyond a few anonymous charts on CoinGecko’s obscure listings. Compare that to tokens like ARPA, a blockchain project focused on secure multi-party computation with real enterprise adoption, which actually explains how its token is used. YAE doesn’t even try. It’s not a project. It’s a label on a file nobody remembers why they downloaded.

So why does it still exist? Because crypto is full of leftovers. Old airdrops. Forgotten testnets. Wallets that never got cleared out. People still trade these tokens—not because they believe in them, but because they’re hoping someone else will buy them for more. It’s the same reason you’ll see listings for Cryptomeda (TECH), a gaming token with zero trading volume and no development since 2021. The market never fully deletes anything. It just buries it.

Here’s what you need to do if you come across YAE: Check if it’s on any major exchange. If not, don’t trade it. Check if there’s a verified team or social media presence. If there isn’t, walk away. Look at the transaction history. If the same few wallets have held it for years with no movement, it’s dead. And if you’re being told to "buy now before it pumps," that’s not advice—it’s a trap.

The posts below don’t all mention YAE. But they all show you what real crypto projects look like—and what the rest are just pretending to be. You’ll find deep dives into tokens with actual utility, airdrops you can safely claim, exchanges you can trust, and scams you should avoid. If you’re looking for clarity in a noisy space, you’re in the right place. Let’s cut through the noise.