Crypto News and Guides from November 2025: Airdrops, Exchanges, and Regulations

When you look at the crypto landscape in November 2025, a month defined by clarity, exposure, and real-world adoption in digital assets. Also known as late 2025 crypto cycle, it was the time when hype finally met reality—where tokens with no supply, exchanges with no users, and airdrops with no mechanism were called out, and the ones building real infrastructure got the spotlight. This wasn’t a month of moonshots. It was a month of sorting truth from noise.

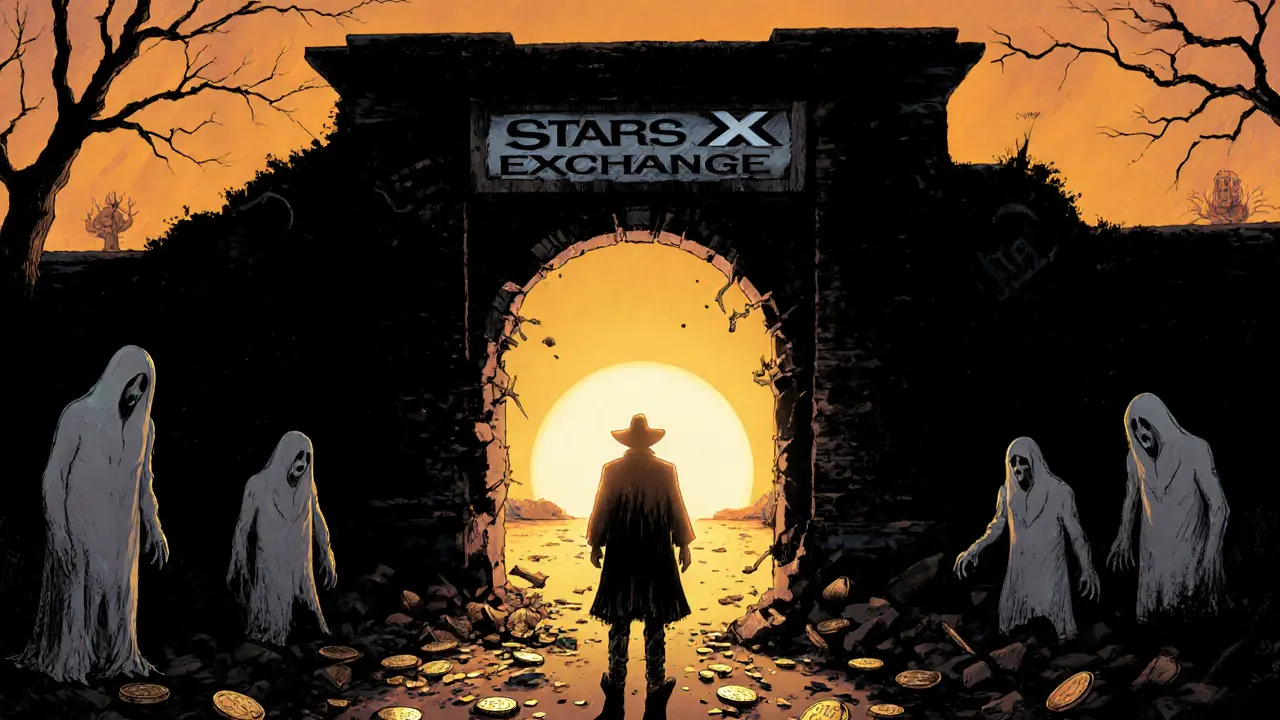

One big theme? crypto airdrop, a distribution method meant to reward users but often abused by scams. Also known as free token giveaways, it was everywhere—but most were fake. The MMS airdrop by Minimals? Zero volume, zero supply, zero chance. Polytrade promised tokens but never delivered. Meanwhile, the real ones, like N1 by NFTify, paid out actual value because they tied rewards to real platform use. If a token claims to be free but you can’t trade it or find it on any exchange, it’s not an airdrop—it’s a trap. And then there’s the crypto exchange, the gateway where people buy, sell, and hold digital assets. Also known as crypto trading platforms, they ranged from the useful to the dangerous. Slingshot Finance offered zero fees and cross-chain swaps without holding your funds. Katana wasn’t an exchange at all—it was a DeFi chain solving liquidity fragmentation. But Stars X, Darb Finance, and ICRYPEX? No regulation, no reviews, no real trading. They were ghosts with websites. These aren’t just names. They’re warnings.

Regulation didn’t take a break either. crypto regulations, the legal rules that govern how digital assets are used, taxed, and protected. Also known as crypto compliance frameworks, Japan’s 2025 PSA amendment became the global benchmark—requiring cold storage, fund segregation, and instant refunds. Meanwhile, in the U.S., institutional adoption kept growing, with Bitcoin ETFs hitting $58 billion and companies like MicroStrategy adding billions to their treasuries. If you’re holding crypto, your jurisdiction’s rules aren’t optional. They’re your safety net—or your trap. And behind all of it? blockchain security, the systems that prevent fraud, theft, and manipulation in decentralized networks. Also known as crypto security protocols, identity verification stopped Sybil attacks, AML tools flagged suspicious trades, and smart contracts automated property sales without middlemen. This isn’t sci-fi—it’s happening now, quietly, in the background.

You won’t find fluff here. No vague predictions. No "maybes." Just what actually happened: which tokens collapsed, which exchanges were real, which airdrops were scams, and which regulations made a difference. Whether you’re tracking your crypto portfolio, checking if your exchange is legit, or trying to avoid a fake token, everything you need is below—clear, direct, and tested by real data.