Russia Crypto Trading Eligibility Calculator

Russia's March 2025 regulations require "especially qualified investors" to trade crypto legally. Check if you qualify based on your financial situation.

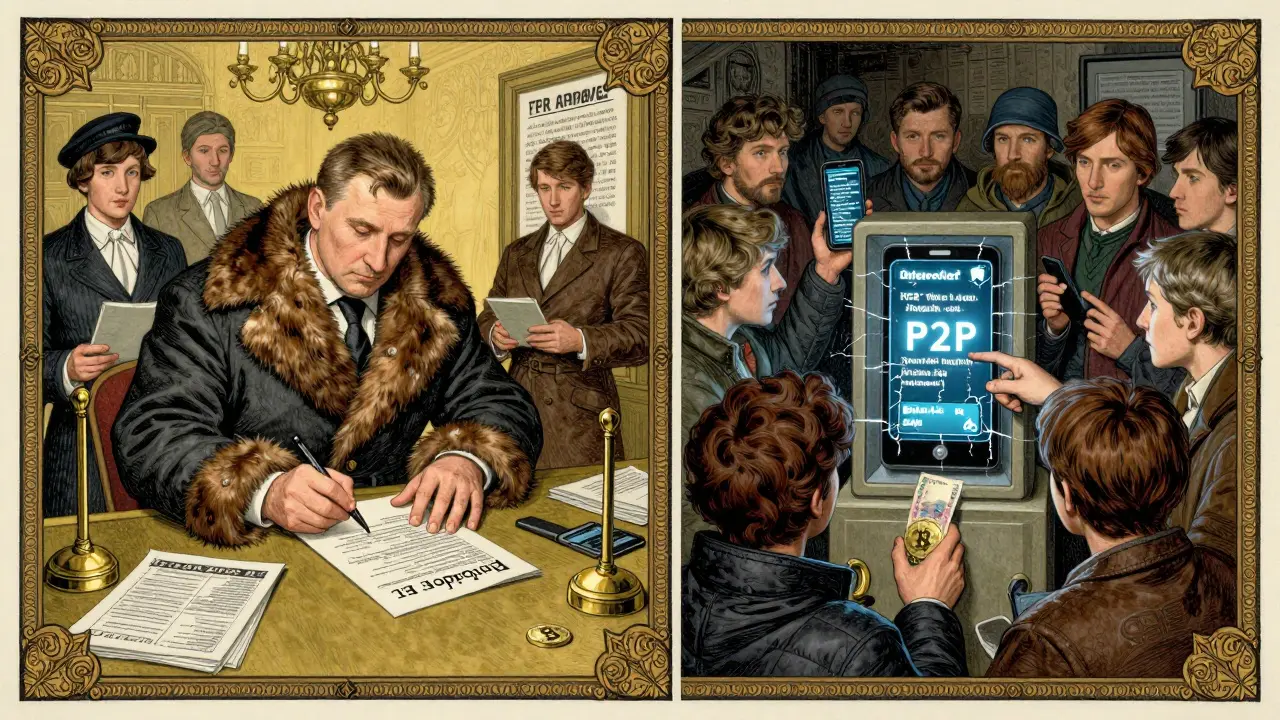

On January 1, 2021, Russia made it illegal to use Bitcoin or any other cryptocurrency to pay for coffee, groceries, or even a taxi ride. But at the same time, the government quietly opened a backdoor for big businesses to use crypto for international trade. This isn’t confusion-it’s a carefully calculated split. Russia doesn’t want its citizens using Bitcoin to avoid the ruble. But it also doesn’t want to lose control over how money flows out of the country, especially under Western sanctions. The result? A system where owning crypto is legal, spending it domestically is banned, and using it abroad is allowed-if you’re rich enough, big enough, and willing to jump through enough hoops.

Domestic Crypto Use: Strictly Forbidden

If you walk into a store in Moscow or Novosibirsk and try to pay with Bitcoin, you’re breaking the law. The Russian government doesn’t just discourage it-they enforce it. The ban isn’t a suggestion. It’s written into Federal Law No. 114-FZ, passed in 2020 and enforced starting January 1, 2021. Cryptocurrencies are recognized as digital assets, not money. That means you can hold them, trade them, mine them-but you can’t use them to buy anything inside Russia. This rule hits everyday users hard. Many Russians turned to crypto during the ruble’s instability after 2022, especially when Western banks cut off access to Visa and Mastercard. But now, even if you’ve got Bitcoin sitting in your wallet, you can’t use it to pay your internet bill or buy a phone online from a Russian seller. The only way to convert crypto to rubles is through licensed exchanges, and even then, banks often freeze accounts linked to crypto activity. According to a July 2025 survey by the Russian Crypto Association, 57% of users reported having their bank accounts frozen during fiat conversions. The Bank of Russia’s stance is clear: cryptocurrencies are too volatile and unregulated to be used as payment. Governor Elvira Nabiullina has repeatedly called them “not issued or guaranteed by any jurisdiction.” That’s the official line. But behind the scenes, the real fear is losing monetary control. If people start paying with Bitcoin, the ruble weakens further. And if the state can’t track those transactions, it loses tax revenue and AML oversight.International Crypto Trade: The Loophole for Big Players

Here’s where things get strange. While you can’t use Bitcoin to pay for your groceries, a Russian oil exporter can use it to pay a Chinese buyer for machinery. That’s thanks to Law No. 382-FZ, passed in summer 2024. This law created an experimental legal regime (EPR) that allows crypto payments for international trade-but only for registered entities. To qualify, a company must register with the Bank of Russia, install real-time transaction monitoring systems capable of handling 1,000 transactions per second, and link every crypto transaction to a Russian bank account with full KYC. They also need to report everything to the Federal Tax Service’s new CryptoTrack system. The process takes an average of 11.3 weeks and costs about 1.8 million rubles ($22,500) in compliance fees. Only 1,842 entities have completed this since the law launched in 2024. Ninety-two percent of them are banks or financial firms-not businesses. The result? Only the biggest, wealthiest companies can use crypto internationally. A small IT startup in Kazan trying to export software to Iran? They’re stuck. They can’t afford the 17 documents, the legal consultants, or the months of waiting. Meanwhile, state-owned energy giants and sanctioned arms exporters are quietly shifting billions in trade to crypto, mostly to China (47%), Iran (28%), and Belarus (15%). In the first half of 2025 alone, Russia moved $3.2 billion in crypto-facilitated exports.

Who Can Even Trade Crypto? Only the Ultra-Rich

Even if you’re not a company, you might think you can trade Bitcoin on a domestic exchange. Not so fast. The Bank of Russia’s March 2025 rules say you must be an “especially qualified investor” to trade crypto legally. That means you need either:- At least 100 million rubles ($1.2 million) in financial assets, or

- An annual income of over 50 million rubles ($580,000)

Miners, Taxes, and the Hidden Economy

Mining is still legal in Russia-and it’s booming. The country ranks 8th globally in Bitcoin mining, with 1.2 gigawatts of power dedicated to it. But it’s not free. Since January 2025, all mining operations must register with Roskomnadzor and cap their energy use at 150 megawatts per facility. That’s designed to keep small miners out and push them toward state-aligned energy conglomerates. And then there’s the tax. Crypto is now legally classified as property. Any profit from selling Bitcoin is taxed at 13%, the same as other capital gains. You have to file quarterly reports. The Federal Tax Service says only 1,842 entities have registered under the EPR-but they don’t track individual traders. That means most people who trade crypto are either not reporting it, or they’re doing it illegally. The underground market is growing. Telegram crypto groups are filled with offers to swap Bitcoin for rubles via Sberbank transfers. Some users pay a 5-10% premium to avoid bank freezes. Others use crypto ATMs in border cities like Krasnodar or Vladivostok. The government knows this is happening. In July 2025, the State Duma proposed fines of up to 200,000 rubles ($2,500) for individuals caught using crypto for domestic payments-and confiscating the crypto itself. Those fines take effect January 1, 2026.

Why This System Won’t Last

Russia’s approach is a paradox. It wants to isolate itself from Western financial systems, yet it’s creating its own isolated crypto economy. It bans everyday use to protect the ruble, but lets the elite use crypto to bypass sanctions. It claims to want financial stability, yet its rules push users into unregulated channels. The numbers don’t lie. Despite the ban, Russia ranks 15th globally in crypto adoption. The Central Bank predicted 10,000 companies would join the EPR by now. Only 1,842 did. Most of them are banks-not exporters or retailers. The system is too expensive, too slow, too bureaucratic. And the people? They’re not buying it. The Russian Crypto Association’s survey found 92% oppose the 100 million ruble threshold. “The 100 million ruble rule means only oligarchs can legally trade,” one user wrote on Dvach. The Bank of Russia says it’s protecting consumers. But the real goal is control. They don’t want Bitcoin replacing the ruble. They don’t want citizens bypassing capital controls. And they definitely don’t want crypto undermining their sanctions strategy. But as long as the ruble stays unstable and Western banks stay hostile, people will find a way. The government’s answer isn’t to adapt-it’s to punish. The proposed biometric verification for crypto transactions above 500,000 rubles, the planned ban on stablecoins by 2027, the expanded monitoring of non-custodial wallets-all of it points to one thing: Russia isn’t trying to integrate with crypto. It’s trying to contain it.What’s Next for Russia and Crypto?

The experimental legal regime runs until 2027. After that, the government will decide whether to expand access, tighten it further, or scrap it entirely. Analysts are split. The World Bank says Russia’s approach may hinder its integration into alternative payment systems. The IMF says the investor thresholds are “excessively restrictive.” Cybersecurity experts warn that heavy surveillance will just drive activity underground. One thing is certain: the divide between domestic and international crypto use isn’t just policy-it’s a social rift. On one side, the wealthy, the connected, the sanctioned. On the other, millions of ordinary Russians who still need to buy food, pay rent, and send money home. The government thinks it’s controlling the future. But the future is already happening-in Telegram chats, in P2P apps, in the back rooms of Moscow exchanges. And it’s not waiting for permission.Can I legally use Bitcoin to pay for things in Russia?

No. Since January 1, 2021, it has been illegal to use Bitcoin or any cryptocurrency to pay for goods or services within Russia. The law allows ownership, trading, and mining-but not spending crypto domestically. Violating this rule can lead to fines of up to 200,000 rubles ($2,500) and confiscation of the cryptocurrency, starting January 1, 2026.

Can Russian businesses use crypto for international payments?

Yes, but only under strict conditions. Since summer 2024, businesses can use crypto for international trade if they register with the Bank of Russia under the Experimental Legal Regime (EPR). This requires real-time transaction monitoring, full KYC, API integration with tax systems, and minimum capital reserves. Only 1,842 entities have completed this process as of mid-2025, mostly banks-not small businesses.

Why is there a 100 million ruble threshold to trade crypto?

The Bank of Russia set this limit in March 2025 to restrict crypto trading to “especially qualified investors.” Only those with over 100 million rubles ($1.2 million) in assets or an annual income above 50 million rubles ($580,000) can legally trade. This is one of the highest thresholds in the world-far above Japan’s $320,000 or India’s $25,000. The goal is to limit exposure to retail investors, but critics say it only benefits the ultra-rich and fuels illegal activity.

Is crypto mining legal in Russia?

Yes, mining is legal and even encouraged in some regions. Since 2021, miners must register with Roskomnadzor and comply with energy limits of 150 MW per facility. Russia ranks 8th globally in Bitcoin mining, with 1.2 GW of installed capacity. However, the government uses energy caps and tax rules to steer mining toward state-aligned power providers and away from small operators.

What happens if I get caught using crypto for domestic payments?

Starting January 1, 2026, individuals caught using crypto for domestic payments face fines of 100,000-200,000 rubles ($2,500-$5,000), and the cryptocurrency involved will be confiscated. Banks may also freeze your accounts if they detect crypto-related activity. Enforcement is still ramping up, but the legal framework is already in place.

Can I convert Bitcoin to rubles in Russia?

You can, but it’s risky. Only licensed exchanges are allowed to convert crypto to rubles, and banks often freeze accounts linked to these transactions. Many users turn to peer-to-peer platforms or offshore exchanges, but these are not legal under Russian law. About 57% of users report having their bank accounts frozen during fiat conversion attempts.

Are stablecoins banned in Russia?

Not yet, but they’re next. The Ministry of Finance proposed in July 2025 to extend the domestic crypto payment ban to include all stablecoins by 2027. The government cites risks from algorithmic stablecoins like TerraUSD, which collapsed in 2022. This move would further restrict access to dollar-pegged assets, which many Russians rely on to protect savings from ruble inflation.

So Russia’s basically saying, ‘You can own Bitcoin, but you can’t use it to buy bread’ - while the oligarchs are quietly moving billions to China. Classic. The hypocrisy is almost poetic.

It’s like banning water bottles but letting the rich refill their private jets with bottled rain.

Imagine being told you can’t pay for your coffee with Bitcoin… but your boss can pay for a warship with it. 😔

They’re not protecting the ruble. They’re protecting their power.

And the 100M ruble threshold? That’s not a filter - it’s a wall. 🧱

Of course the government wants to control crypto - because if regular people could bypass the ruble, they’d realize how broken the whole system is. This isn’t policy. It’s panic.

And now they’re going to biometric-track every transaction? LOL. People will just use Telegram bots and laugh all the way to the bank.

Let me just say - I’ve lived through hyperinflation in Venezuela, and this? This is worse. At least in Venezuela, you could use crypto to buy food. Here, you can’t even pay your internet bill. You can mine Bitcoin, but you can’t feed your kid with it?

And the fact that only banks qualify for the EPR? That’s not regulation - that’s a tax on ambition. Small businesses? They’re just collateral damage in this game of financial chess.

Meanwhile, the 57% of users with frozen accounts? That’s not a bug - it’s a feature. They want you scared. They want you silent. But guess what? People are still trading. On P2P. On Telegram. On the dark web. You can’t ban human ingenuity.

And the stablecoin ban by 2027? That’s the final nail. People aren’t using crypto to rebel - they’re using it to survive. And when you outlaw survival, you don’t stop the behavior. You just make it deadlier.

I’m not Russian. But I’ve watched this movie before. And the ending never goes how the villains expect.

While I appreciate the nuanced analysis presented, I must emphasize the structural implications of this bifurcated regulatory architecture. The institutionalization of crypto as a non-monetary asset while permitting its use in international trade under stringent compliance regimes constitutes a form of financial apartheid. The 100-million-ruble threshold, which exceeds Japan’s by over 300%, is not merely a regulatory filter - it is a deliberate mechanism of elite capture, reinforcing rent-seeking behavior within the state-corporate nexus. Furthermore, the enforcement mechanisms - account freezes, biometric tracking, and retroactive confiscation - signal a broader trend toward algorithmic authoritarianism, wherein financial sovereignty is selectively granted to those with capital and revoked from those without. This is not monetary policy; it is surveillance capitalism dressed in bureaucratic formalism.

so they let the billionaires use crypto to buy weapons from iran but you can't pay for your metro ticket with btc? lol

the real crime is that the government thinks we're dumb enough to fall for this

India would never let this happen. We have our own digital rupee - and it’s controlled, clean, and proud. Russia’s crypto chaos is just another sign of Western decay. They’re scared of their own people. We don’t need Bitcoin to be free - we have the rupee, we have discipline, we have dignity.

Meanwhile, Russians are stuck in a crypto jail built by their own government. Sad.

HAHAHAHAHAHAHAHAHAHAHAHAHA

Russia thinks they're so smart banning crypto for normal people but letting the oligarchs use it to dodge sanctions? Bro. They're not outsmarting anyone - they're just making themselves look like clowns with a $22,500 compliance fee sticker on their foreheads.

Meanwhile, in India, we don't need to jump through hoops to buy a phone with crypto. We just do it. And the government? They shrug and collect taxes.

Stop trying to be a superpower. You can't even control your own citizens' wallets.

There’s a fascinating paradox here: Russia is attempting to create a ‘controlled leak’ in its financial system - permitting crypto flows only through tightly regulated, state-sanctioned conduits, while simultaneously outlawing decentralized, peer-to-peer alternatives. This is not innovation; it is containment. The Experimental Legal Regime (EPR) functions as a regulatory moat: it isolates crypto from the domestic economy while channeling it toward geopolitical objectives. But moats can be crossed - and the 68% of users using non-custodial wallets are already building bridges. The state’s reliance on KYC, API integration, and transaction monitoring creates a single point of failure: human behavior. When compliance costs exceed 1.8 million rubles, and only banks qualify, you don’t create a new financial system - you create a black market with paperwork. The real question isn’t whether this will collapse - it’s how violently.

It’s like they built a luxury yacht and told everyone else to swim.

The rich get to use crypto to buy weapons from Iran. The rest of us? We can’t even buy a phone with it. And they wonder why people are using Telegram bots and crypto ATMs on the border?

This isn’t about the ruble. It’s about control. And control always backfires. People don’t stop wanting freedom just because you make it illegal. They just get better at hiding it.

I just want to say how heartbreaking this is. I have friends in Moscow who are trying to send money to their families, and they can’t even use crypto to help. It’s not about politics - it’s about survival. And the government’s response? More fines. More freezes. More fear.

They’re not protecting the economy. They’re protecting their own power. And the people? They’re just trying to eat.

It breaks my heart. 💔

Look - I get why they did this. The ruble’s shaky. Sanctions are crushing. But banning domestic crypto while letting the elite use it internationally? That’s not strategy. That’s a betrayal.

They could’ve built a digital ruble with crypto tech. Instead, they built a prison - and gave the key to the billionaires.

And now, the people are finding the back door. No law can stop that.

Wait… are you telling me the government is tracking every crypto transaction… but only the ones that matter? What if this is all a setup? What if they’re using this to build a national surveillance database under the guise of ‘financial stability’? What if the real goal isn’t to stop crypto - it’s to map EVERYONE’S financial behavior? And when the time comes… they’ll just freeze everything. All at once. Like a switch. You think you’re safe because you use a non-custodial wallet? Think again. They’ve already got your IP. Your device ID. Your phone number. Your bank account. This isn’t about money. It’s about total control. And we’re all just test subjects.

They’re not banning crypto.

They’re building the panopticon.

And we’re handing them the keys.

So you can mine Bitcoin but not buy coffee with it? Wow

So the rich get to use crypto to buy warships and the rest of us get to beg for rubles

And the 100 million ruble thing? That’s not a rule - that’s a joke

Who even came up with this? A bored bureaucrat with a vodka hangover?

Also I’m not even mad

I’m just impressed

The regulatory architecture is a textbook case of institutionalized rent-seeking under the guise of financial prudence. The 100-million-ruble threshold constitutes an oligarchic choke point, effectively weaponizing financial exclusion to reinforce class stratification. The EPR, while ostensibly facilitating international trade, functions as a regulatory capture mechanism - channeling crypto flows exclusively through state-aligned financial institutions, thereby neutralizing any potential for decentralized monetary sovereignty. Moreover, the enforcement of biometric verification and real-time transaction monitoring signals a transition from monetary policy to algorithmic authoritarianism. The Bank of Russia’s claim of consumer protection is a rhetorical smokescreen; the true objective is the consolidation of monetary hegemony under a technocratic autocracy. The result? A two-tiered financial ecosystem: one for the sanctioned elite, and one for the surveilled masses. This is not policy. It is dystopia with a compliance checklist.

It’s wild how the same government that says ‘crypto is dangerous’ is quietly moving billions in it to China.

They don’t hate crypto.

They just hate that you might have more control than they do.