HSM Cost Calculator for Cryptocurrency Exchanges

Exchange HSM Implementation Cost Calculator

Estimate the total cost of implementing Hardware Security Modules for your cryptocurrency exchange based on your specific requirements

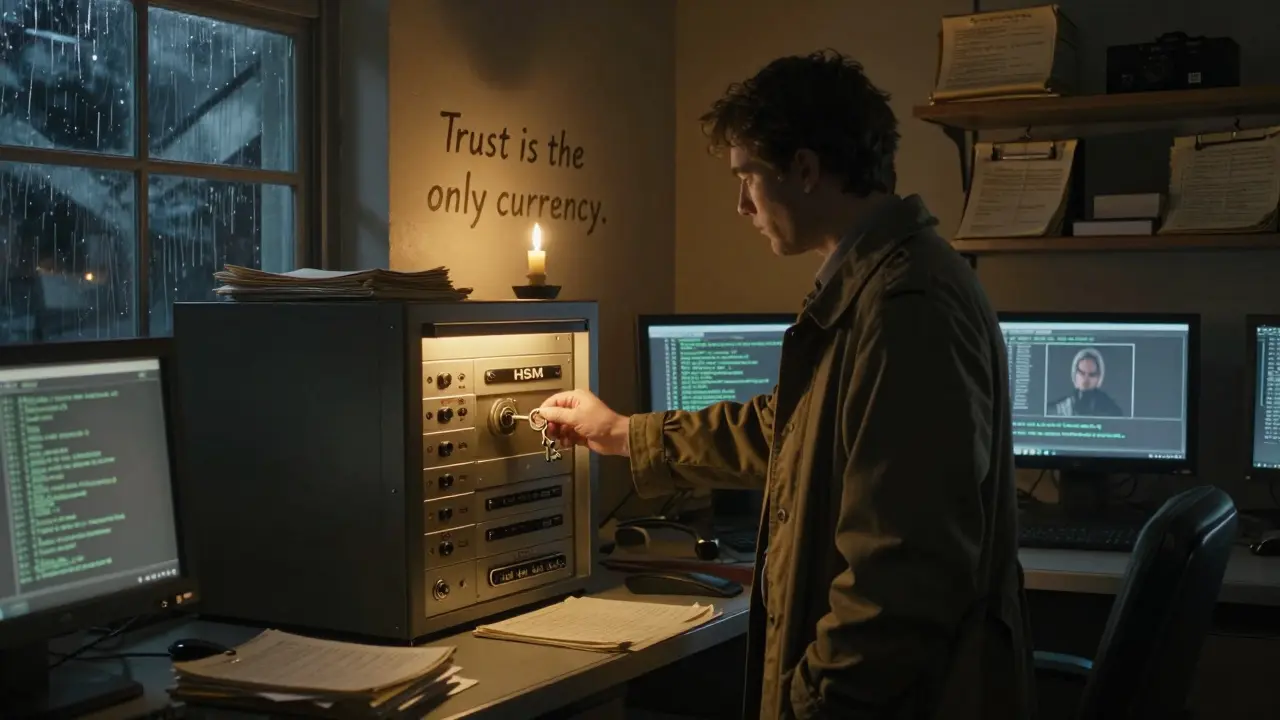

When a cryptocurrency exchange processes a withdrawal, it doesn’t just click a button. Behind the scenes, a HSM is doing the real work-generating cryptographic signatures, verifying identities, and ensuring that no private key ever leaves a hardened metal box. This isn’t science fiction. It’s the baseline security standard for every major exchange today. If your funds are stored on an exchange that doesn’t use HSMs, you’re not just taking a risk-you’re gambling with your assets.

What Exactly Is an HSM?

A Hardware Security Module, or HSM, is a physical device built to keep cryptographic keys safe. Think of it like a digital vault with its own brain. It doesn’t just store keys-it generates them, uses them to sign transactions, and destroys them when needed. The key point? Private keys never leave the HSM. Not in memory. Not in logs. Not in backups. They’re born inside the device, live inside it, and die inside it. These aren’t普通的 USB drives. They’re certified to FIPS 140-2 Level 3 or Level 4 standards, meaning they’re built to resist physical tampering. If someone tries to open the case, cut a wire, or probe the circuit board, the HSM wipes itself clean. Some models even detect temperature changes or electromagnetic interference and auto-erase. That’s not paranoia-it’s necessity. HSMs became non-negotiable after Mt. Gox lost 850,000 BTC in 2014. That hack wasn’t because someone cracked a password. It was because keys were stored on regular servers, vulnerable to malware and insider threats. Since then, every serious exchange has moved to HSM-based custody. Today, 97 of the top 100 exchanges by trading volume use them, according to CryptoCompare’s 2023 report.How HSMs Handle Key Management

Managing keys isn’t just about storing them. It’s about controlling every step of their life cycle:- Provisioning: The HSM generates keys using a hardware-based random number generator. These aren’t pseudo-random-they’re truly unpredictable, based on physical noise inside the chip.

- Storage: Keys are encrypted before being backed up, but even those backups are encrypted with keys that live only inside other HSMs. No single person can access a full key.

- Deployment: Keys are loaded into the HSM’s secure environment, where they can only be used for specific operations like signing Bitcoin transactions.

- Rotation: Keys are replaced regularly. Some exchanges rotate keys every 30 days. Others do it after every 10,000 transactions. The policy depends on risk tolerance.

- Archiving and Disposal: Old keys are kept encrypted for audit purposes. When it’s time to destroy them, the HSM physically deletes the key material and logs the action.

On-Premises vs. Cloud HSMs

Exchanges have two main choices: buy and install HSMs in their own data centers, or rent them from the cloud. On-premises HSMs, like Thales Luna HSM 7, offer raw speed. They can handle over 20,000 RSA signatures per second. For an exchange processing thousands of trades per minute, that speed matters. Latency is under 2 milliseconds. That’s faster than a human blink. But they cost $25,000 each, plus 15-20% annual maintenance. You need engineers who know PKCS #11, FIPS compliance, and hardware integration. Coinbase spent nine months getting theirs right. Cloud HSMs, like AWS CloudHSM or Azure Dedicated HSM, are easier to scale. You spin up a new instance in minutes. They offer geographic redundancy-if one data center goes dark, another takes over. That’s what saved a major European exchange during a 2021 power outage. But they add 5-10 milliseconds of latency. For high-frequency trading bots, that delay can mean lost profits. Most exchanges now use a hybrid model. Hot wallets-where funds are ready for fast withdrawals-run on on-premises HSMs for speed. Cold wallets-where most of the funds are stored long-term-use cloud HSMs for backup and disaster recovery. Fireblocks reported in 2023 that 63% of top exchanges use this exact setup.

Multi-Party Authorization: The Real Game-Changer

Even the best HSM can be useless if one person has too much power. That’s why exchanges don’t rely on single keys. They use multi-party computation (MPC) and multi-signature schemes. Instead of one key signing a withdrawal, you need three out of five keys. Those keys are stored in different HSMs, in different cities, controlled by different teams. One person can’t move funds alone. Even if a hacker compromises one HSM, they still can’t complete the transaction. Kraken’s system, described in their 2021 security whitepaper, uses a 3-of-5 setup. Their HSMs are in New York, Frankfurt, and Singapore. Each requires manual approval from a different team. No single engineer, no matter how trusted, can initiate a withdrawal without help. This isn’t just security theater. It’s what stopped a $20 million attempt at a top-20 exchange in 2022. The attacker got access to one HSM-but couldn’t trigger the other two approvals. The logs showed the failed attempt. The funds were never touched.Why Software-Only Key Management Fails

Some smaller exchanges still use software-based key storage. They store private keys in encrypted files on servers. It’s cheaper. It’s easier. And it’s dangerously wrong. In 2020, KuCoin was hacked. The attacker didn’t break the HSM-they stole API keys from a compromised admin workstation. Those keys had permissions to trigger withdrawals. The HSM was secure, but the system around it wasn’t. That’s the lesson: HSMs aren’t magic. They’re only as strong as the policies around them. If you don’t enforce least-privilege access, monitor logs, rotate credentials, or segment networks, the HSM becomes a shiny ornament. Dr. Aggelos Kiayias from Input Output Global put it bluntly in his 2023 BlackHat talk: “HSMs create a false sense of security if not properly integrated with comprehensive key lifecycle policies.”What Happens When HSMs Fail

The most famous HSM failure wasn’t a hack-it was neglect. QuadrigaCX collapsed in 2019 after its founder died. He was the only person who knew the passwords to the HSMs holding $190 million in customer funds. The HSMs were perfectly secure. But there was no backup. No recovery plan. No second person who could access them. Ernst & Young’s investigation found no signs of breach. Just human error. No key escrow. No multi-person approval. No documentation. That’s why HSM implementation isn’t just about buying hardware. It’s about building processes:- Who can request a withdrawal?

- Who approves it?

- How are backups stored?

- What happens if someone quits or dies?

The Future: Quantum Resistance and Automation

HSMs aren’t standing still. In early 2023, Thales released Luna HSM 7.2 with support for CRYSTALS-Dilithium-a post-quantum cryptographic algorithm. NIST is finalizing these standards now. By 2026, most new HSMs will include them. Why? Because quantum computers could break RSA and ECC encryption within a decade. If you’re still using 2048-bit keys in 2030, your funds are at risk. Meanwhile, automation is rising. The FIDO Alliance is working on integrating HSMs with passkey authentication for withdrawals. Google’s 2023 pilot showed this could reduce phishing attacks by 92%. Imagine withdrawing BTC using your fingerprint or Face ID-verified by an HSM, not a password. HSM-as-a-Service is also growing fast. Thales’ Luna Cloud HSM Services grew 140% year-over-year in 2022. Exchanges that don’t want to manage hardware can now rent secure key management with SLAs, audits, and 24/7 support.Getting Started: What You Need to Know

If you’re building or evaluating an exchange, here’s what you must do:- Require FIPS 140-2 Level 3 or higher HSMs. No exceptions.

- Implement multi-party authorization. At least 3-of-5 key holders.

- Separate hot and cold wallet HSMs. Use on-prem for hot, cloud for cold.

- Log every key operation. Store logs in a separate, immutable system.

- Train your team on PKCS #11, key lifecycle, and audit trails.

- Test your recovery plan. Simulate losing access to one HSM. Can you still operate?

Final Thought: Security Isn’t a Feature-It’s the Foundation

HSMs don’t make an exchange profitable. They don’t make trades faster. They don’t attract users with flashy UIs. But they make users trust you. In crypto, trust is the only currency that matters. Without it, no amount of marketing, liquidity, or innovation will save you. Exchanges that treat HSMs as a cost center lose. Those that treat them as core infrastructure survive-and thrive.When you see a withdrawal go through on an exchange, don’t think about the UI. Think about the metal box, humming in a locked room, signing your transaction with a key that was never seen by human eyes. That’s what keeps your money safe.

What is an HSM in cryptocurrency exchanges?

An HSM, or Hardware Security Module, is a physical device that generates, stores, and uses cryptographic keys for signing cryptocurrency transactions. Private keys never leave the HSM, making it the most secure way to manage digital assets. Exchanges use HSMs to prevent theft, meet regulatory standards, and ensure funds can’t be moved without proper authorization.

Why do exchanges need HSMs instead of software keys?

Software keys are stored on servers and can be stolen through malware, insider threats, or hacking. HSMs are tamper-resistant hardware devices that keep keys isolated from networks and operating systems. Even if a hacker takes over the server, they can’t extract the keys. After the Mt. Gox hack, HSMs became the industry standard because software-only storage is simply too risky.

What’s the difference between on-premises and cloud HSMs?

On-premises HSMs (like Thales Luna) are installed in your own data center. They’re faster-under 2ms latency-and handle over 20,000 signatures per second, ideal for high-volume trading. Cloud HSMs (like AWS CloudHSM) are rented services. They’re easier to scale and offer automatic backups, but add 5-10ms latency, which can hurt high-frequency trading. Most exchanges use both: on-prem for hot wallets, cloud for cold storage.

Can HSMs be hacked?

HSMs themselves are extremely hard to hack. They’re designed to self-erase if tampered with. But the systems around them aren’t. The 2020 KuCoin hack happened because attackers stole API keys from a compromised admin computer-not the HSM. HSMs must be part of a layered security strategy: strong access controls, network segmentation, logging, and multi-party approval.

What happens if you lose access to your HSM?

If you lose access and have no backup or recovery plan, your funds are gone forever. That’s what happened with QuadrigaCX-the founder was the only person who knew the passwords. When he died, $190 million became inaccessible. Proper HSM implementation includes multi-person key control, secure backups stored in different locations, and documented recovery procedures.

Are HSMs required by law?

Yes, in many jurisdictions. The New York Department of Financial Services requires FIPS 140-2 Level 3 or higher HSMs for all licensed virtual currency custodians. The European Central Bank is moving toward similar rules for digital euro custody. Regulators see HSMs as the minimum standard for protecting customer assets.

How much do HSMs cost for exchanges?

On-premises HSMs like Thales Luna cost $25,000+ per unit, with 15-20% annual maintenance. Cloud HSMs like Azure Dedicated HSM charge about $1,968 per month. Implementation takes 3-9 months and requires skilled engineers. The total cost isn’t just hardware-it’s training, integration, and ongoing monitoring. But compared to losing millions in a hack, it’s a small price.

What’s next for HSM technology?

The next big shift is quantum resistance. New HSMs now support post-quantum algorithms like CRYSTALS-Dilithium to defend against future quantum computers. FIDO Alliance is also integrating HSMs with passkey authentication, which could reduce phishing attacks by over 90%. HSM-as-a-Service is growing fast, letting exchanges rent secure key management without buying hardware.

HSMs are the unsung heroes of crypto security 🛡️ I used to think it was all about passwords until I learned how these little metal boxes keep our funds safe. No key ever leaves the box? That’s next-level. I sleep better knowing my BTC is locked down like Fort Knox with a brain.

This is why I only use exchanges with HSMs. No exceptions. If they don’t have it, they don’t get my money. Simple.

HSMs are just a distraction from the real problem centralized exchanges are still central points of failure

The cultural shift here is fascinating-moving from trust-in-code to trust-in-process. HSMs aren’t magic, but they’re the closest thing we’ve got to a cryptographic covenant. I’ve seen teams in Toronto implement this with FIDO2 passkeys and it’s like watching a symphony of security layers. The latency trade-off with cloud HSMs? Real. But for cold storage? Worth every millisecond.

You say HSMs are the baseline... but what about the fact that 97% of top exchanges use them? That’s not proof they’re secure-it’s proof everyone’s just copying each other. Groupthink isn’t a security strategy.

I love how this post doesn’t just say ‘use HSMs’-it shows you *why*. It’s like the difference between being told to wear a seatbelt and understanding how the airbag deploys. And the part about QuadrigaCX? Chilling. We need more stories like this to stop people from treating crypto like a casino.

HSMs are a scam. They’re just fancy boxes that make you feel safe while the real hackers are inside the exchange’s admin panel. They’re not protecting you-they’re protecting the exchange’s PR. And don’t even get me started on cloud HSMs. NSA? Probably has a backdoor.

How often do HSMs actually get physically tampered with in real life?

This is basic stuff. If you're still using software keys in 2024 you're not just careless-you're irresponsible. HSMs are non-negotiable. Period. And if your exchange doesn't use 3-of-5 MPC, you're not secure, you're just lucky so far.

I've seen this before... HSMs... FIPS... NIST... it's all just a show. Behind the scenes? They're still using the same old keys, just hidden in a shiny box. The real theft? The trust you give them. And when it collapses? You're left with nothing. I've lost everything before... I won't be fooled again.

HSMs? More like HSMs™. You think this is security? Nah. This is just corporate theater. The real story? Exchanges are still getting hacked because their devs are using admin passwords like ‘Password123’. The HSM doesn’t care if your API key is sitting in a GitHub repo. This whole thing is a distraction.

HSMs are a Western solution. In Nigeria, we build security differently-through community trust, not metal boxes. Why do we need expensive hardware when we can have human oversight? Your systems are too rigid. Crypto should be free, not locked in a vault.

It’s important to recognize that while HSMs provide an essential technical foundation, the true resilience of any custody system lies in its human and procedural architecture. The QuadrigaCX tragedy wasn’t a failure of hardware-it was a failure of succession planning, documentation, and institutional memory. Without clear protocols for key escrow, multi-party authorization, and emergency access, even the most advanced HSM becomes a monument to complacency. The fact that major exchanges now mandate audits, recovery drills, and cross-regional key distribution reflects a maturing industry-one that understands security is not a feature, but a culture.

This is exactly the kind of clarity the space needs. Too many people think ‘crypto = anonymous = no rules.’ But real security is boring. It’s logs. It’s rotation. It’s people who actually know what PKCS#11 is. Keep pushing this message.

Great breakdown. One thing I’d add: even with HSMs, always verify the exchange’s transparency reports. Some use HSMs but don’t publish attestation logs. If they won’t show you the proof, treat it like a black box.

What happens when the HSM vendor goes out of business? Like if Thales suddenly shuts down their Luna line? Are we locked in? Has anyone mapped out vendor risk for HSMs?