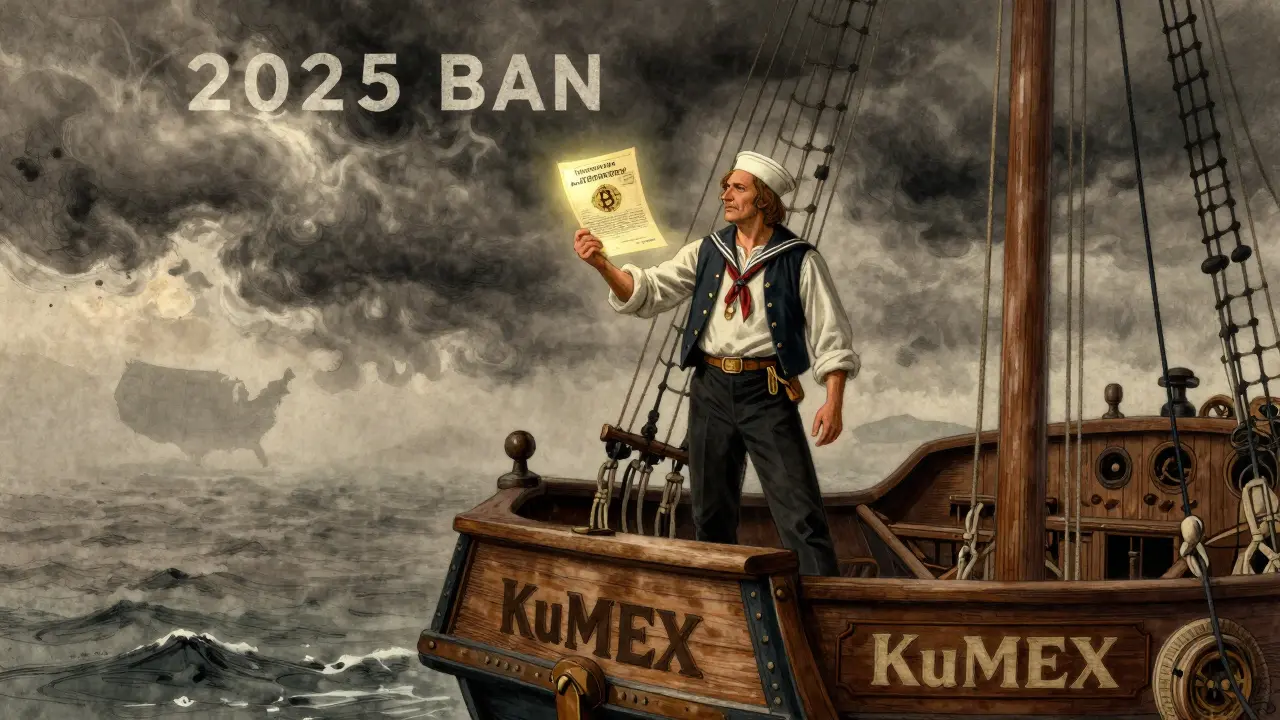

If you're looking for a crypto futures exchange with low fees and solid tech, KuMEX might catch your eye. But here’s the catch: if you’re in the U.S., you can’t trade anymore. Not since January 2025, when KuCoin - the parent company behind KuMEX - pleaded guilty to U.S. regulatory violations and agreed to shut down all trading operations for American users. That’s not a small detail. It’s the biggest factor in whether KuMEX is right for you.

What Is KuMEX, Really?

KuMEX isn’t a standalone exchange. It’s the futures trading arm of KuCoin, one of the top 10 cryptocurrency platforms by volume. Think of it like this: KuCoin handles spot trading - buying and selling Bitcoin, Ethereum, and other coins directly. KuMEX is where you bet on price movements using leverage, without owning the actual asset. It’s all about futures contracts, mostly Bitcoin. The platform launched with one goal: give traders a fast, reliable way to trade crypto derivatives. And it delivers. KuMEX’s trading engine claims to handle up to 1 million transactions per minute with under 1 millisecond latency. That’s faster than most retail platforms. For active traders, that speed matters. A delay of even half a second can mean the difference between a profitable trade and a liquidation.How KuMEX Handles Security

Security is where KuMEX stands out from many smaller futures exchanges. The platform uses institutional-grade practices: the vast majority of funds are stored in cold wallets, offline and unreachable by hackers. Only a small portion sits in multisignature hot wallets, just enough to cover daily withdrawals and trades. This setup mirrors what banks and hedge funds use. KuMEX also runs an insurance fund. When a trader’s position gets liquidated, any leftover margin goes into this fund. That pool acts as a buffer. If the market crashes hard and liquidations cascade, the insurance fund covers losses for profitable traders so they don’t get wiped out by system-wide failures. It’s not perfect, but it’s one of the better risk controls you’ll find outside of Binance Futures.Fees: Why KuMEX Is Cheaper Than Most

Fees are where KuMEX really shines. The taker fee is just 0.06%. Compare that to Binance Futures at 0.04% (but higher for low-volume users), Bybit at 0.075%, or BitMEX at 0.075%. For high-frequency traders, that 0.015% difference adds up fast. On a $1 million trading volume, you’d save $150 just by choosing KuMEX over Bybit. Maker fees? They’re even better. You get rebates - meaning you earn money just by placing limit orders that add liquidity. The rebate starts at 0.02% and increases with your trading volume. If you’re doing over $10 million monthly, you can get up to 0.04% back. That’s a real incentive to be a market maker.Trading Interfaces: Lite vs Advanced

KuMEX doesn’t force you into one experience. It gives you two platforms:- Lite Mode: Clean, simple, no clutter. Perfect if you’re new to leverage trading. You can set your leverage, pick a position size, and hit buy or sell. No charts, no indicators, no complex orders.

- Advanced Mode: Full professional toolkit. Charting with TradingView integration, conditional orders, trailing stops, OCO (one-cancels-other), and API access for bots. This is what serious traders use.

Regulatory Reality: U.S. Users Are Locked Out

This is the hard truth. As of January 2025, KuCoin (and therefore KuMEX) is banned from serving U.S. customers. You can’t deposit. You can’t open new positions. You can’t withdraw crypto unless you had funds there before the ban. Even if you’re a U.S. citizen living abroad, you’re flagged if your IP or device history shows U.S. ties. KuCoin paid a $50 million fine and agreed to a two-year trading moratorium in the U.S. That’s not a temporary pause. That’s a full exit. For American traders, KuMEX is now a ghost platform. No trading. No new accounts. No support for U.S.-based issues. If you’re in the U.S., you’re better off looking at platforms that are licensed and compliant - like Bitfinex (for some states) or Kraken Futures. KuMEX is not an option.Asset Selection: Bitcoin-Only Focus

KuMEX doesn’t offer dozens of altcoin futures. It focuses on Bitcoin. That’s it. No Ethereum futures. No Solana. No Dogecoin. Just BTC/USDT perpetual contracts. That might sound limiting. But there’s a reason: Bitcoin has the deepest liquidity and tightest spreads in crypto futures. For traders who only care about Bitcoin volatility, KuMEX gives them the cleanest, fastest, cheapest route. For anyone wanting to hedge altcoins or trade multiple coins at once, this is a dealbreaker. Compare that to Binance Futures, which supports over 100 trading pairs. Or Bybit, with 80+. KuMEX’s narrow focus is a strength for some, a weakness for others.Customer Support and Experience

User reviews on platforms like Revain suggest KuMEX’s support is better than average. Responses come within 12-24 hours, and most issues get resolved without endless back-and-forth. The interface is clean, and the app works reliably on both iOS and Android. But there are complaints. Some users say the platform lacks educational content. No tutorials, no webinars, no beginner guides. If you don’t already know how futures work, you’re on your own. Also, the API documentation is solid for coders, but poorly explained for non-developers.

Who Is KuMEX For?

KuMEX is a specialist tool. It’s not for everyone.- Best for: Traders outside the U.S. who focus on Bitcoin, want low fees, and need fast execution. Advanced traders who use bots and care about latency. People already using KuCoin for spot trading and want seamless integration.

- Avoid if: You’re in the U.S., you trade altcoins, you need fiat on-ramps, or you’re a beginner looking for hand-holding. Also avoid if you want a wide selection of trading pairs or educational resources.

How KuMEX Compares to the Competition

| Feature | KuMEX | Binance Futures | Bybit |

|---|---|---|---|

| Taker Fee | 0.06% | 0.04% (varies) | 0.075% |

| Maker Rebate | Up to 0.04% | Up to 0.02% | Up to 0.025% |

| Trading Pairs | Bitcoin only | 100+ | 80+ |

| U.S. Access | No | No | No |

| Speed (Latency) | <1ms | <5ms | <10ms |

| Insurance Fund | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Testnet: Try Before You Risk Real Money

One underrated feature: KuMEX has a full testnet. You can access it attestnet.kumex.com. It’s a mirror of the live platform with fake USDT. You can test your strategies, automate bots, or practice leverage trading without spending a cent. No KYC needed. It’s perfect for learning how the platform behaves under stress.

Final Verdict

KuMEX is a technically excellent futures exchange - fast, secure, cheap, and well-built. But it’s not for everyone. If you’re outside the U.S., focused on Bitcoin, and care about execution speed and low fees, it’s a top-tier option. If you’re in the U.S., you’re out of luck. If you want to trade altcoin futures or need hand-holding, look elsewhere. The January 2025 regulatory blow has changed everything. KuMEX is no longer a global player. It’s now a niche tool for international Bitcoin traders who know what they’re doing. And for that group, it still delivers.Is KuMEX still operational in 2025?

Yes, KuMEX is still operational - but only for users outside the United States. Since January 2025, KuCoin (KuMEX’s parent company) has been banned from serving U.S. customers. Trading, deposits, and new account creation are blocked for U.S. residents. Only withdrawal access remains for existing users.

Can U.S. users trade on KuMEX?

No. U.S. users cannot open new accounts, deposit funds, or place trades on KuMEX. The platform complies with a U.S. regulatory settlement that prohibits all trading activities for American residents. Even using a VPN won’t bypass the restrictions - KuCoin now flags U.S.-based IP addresses and device fingerprints.

What cryptocurrencies can I trade on KuMEX?

KuMEX currently offers only Bitcoin (BTC) perpetual futures contracts paired with USDT. There are no Ethereum, Solana, or altcoin futures available. The platform is designed specifically for Bitcoin traders who want low fees and high-speed execution on the most liquid crypto asset.

Are KuMEX fees lower than Binance Futures?

Yes, for taker fees, KuMEX charges 0.06% compared to Binance’s 0.04% base rate. However, Binance offers lower fees for high-volume traders, and its maker rebates are lower. For mid-tier traders, KuMEX often ends up cheaper overall, especially when factoring in its higher maker rebates (up to 0.04%) and faster execution speed.

Does KuMEX have a mobile app?

Yes, KuMEX has official mobile apps for both iOS and Android. The app mirrors the web platform’s two modes: Lite and Advanced. It supports real-time charting, order placement, and API syncing. Performance is smooth, even during high volatility.

Is KuMEX safe to use?

Yes, for non-U.S. users, KuMEX is considered one of the safer futures platforms. It uses cold storage for most funds, multisignature hot wallets, and an insurance fund to cover liquidation gaps. Its infrastructure is backed by KuCoin, which has operated for over 7 years with no major hacks. However, like all crypto exchanges, it’s not FDIC-insured and carries inherent blockchain risks.

What’s the difference between KuCoin and KuMEX?

KuCoin is the main spot exchange where you buy and sell crypto directly with fiat or other coins. KuMEX is its separate futures platform for leveraged trading - you don’t own the asset, you bet on price changes. They share the same login and KYC system, but KuMEX doesn’t support spot trading, and KuCoin doesn’t offer futures.

Can I use bots on KuMEX?

Yes, KuMEX offers a full REST and WebSocket API with support for automated trading bots. The API includes all order types, position management, and real-time market data. Many professional traders use Python, Node.js, or C# bots to automate strategies on KuMEX. The testnet environment lets you debug bots risk-free before going live.

KuMEX? More like Ku-NOPE for Americans. They got owned by the SEC and now we're stuck with Kraken's overpriced fees. Classic case of 'you had one job.'

I'm from South Africa and I love KuMEX 😊 The speed is unreal and the fees? Like a dream. But I feel bad for my US friends who can't even test it out. Hope they find something good soon 💙

The assertion that KuMEX's 0.06% taker fee is competitively lower than Binance's 0.04% is empirically misleading. Binance's tiered fee structure, contingent upon 30-day trading volume and BNB holdings, renders such a comparison statistically invalid. Furthermore, the omission of maker-taker dynamics in the analysis constitutes a fundamental flaw in economic reasoning.

Interesting. But why should anyone care about a platform that can't even serve its largest market? Seems like a luxury problem for people who don't have to pay rent.

If you're using KuMEX, you're either a degenerate with a VPN or a masochist who likes slow withdrawals. Real traders use Binance or OKX. This is just crypto cosplay.

KuMEX is the Swiss watch of crypto futures - precision-engineered, hyper-specialized, and utterly useless if you need to tell time in a different timezone. Bitcoin-only? That's not focus, that's fear. You're trading a single asset on a platform that won't even let you hedge your altcoin bag? That's not strategy, that's surrender.

As someone from India, I appreciate how KuMEX keeps things clean. No noise, no gimmicks. Just pure BTC trading. But I do wish they had more educational content - many new traders here don’t even know what liquidation means. Maybe a simple guide in multiple languages?

You call this 'fast'? 1ms latency? That’s a toddler with a stopwatch. Real traders use institutional FIX APIs with sub-100μs latency. This is retail theater dressed up as engineering.

I'm so glad someone finally broke this down without hype. So many posts act like KuMEX is some secret weapon - but it's really just a very good tool for a very narrow group. The testnet is the real MVP though. I used it to train my bot for weeks before going live. No regrets.

KuMEX is dead to me. I got locked out in Jan and still can't withdraw my 0.3 BTC. Support ghosted me for 3 weeks. Now I'm on Bybit and paying extra fees just so I don't cry myself to sleep. 😔