Nigeria Crypto FX Savings Calculator

How Crypto Can Save You Money

Traditional banks in Nigeria often charge high fees and offer poor exchange rates. Crypto transactions via P2P platforms can provide better rates for international transfers. Calculate your potential savings using this tool based on real-world data from Nigeria's crypto market.

Your Results

Traditional Banking

Crypto Exchange

Your Savings

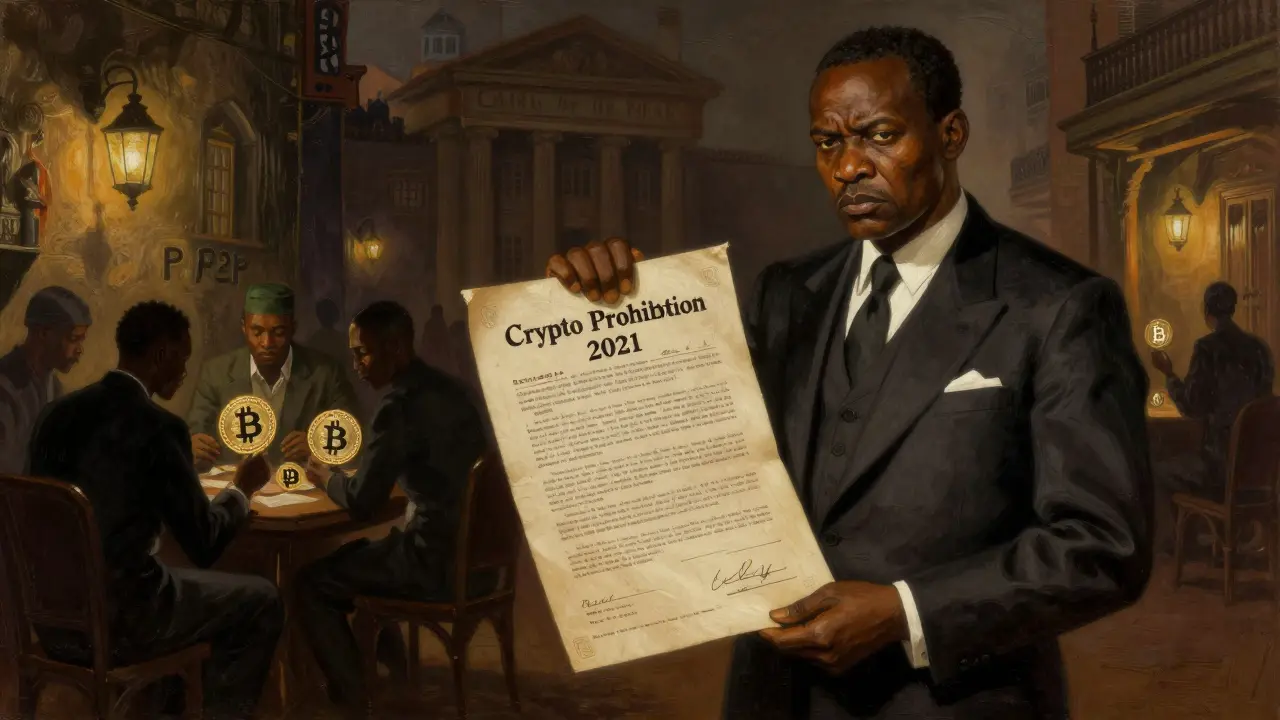

Insight from Article: According to the article, many Nigerians use crypto to bypass expensive traditional forex channels. The 2021 ban pushed users to P2P platforms where they could get better rates than banks, though with higher risks.

On February 5, 2021, the Central Bank of Nigeria (CBN) dropped a bombshell: all commercial banks were banned from handling cryptocurrency transactions. The message was clear-crypto was a threat to financial stability. Banks froze accounts, exchanges shut down, and users were forced into peer-to-peer (P2P) markets just to buy Bitcoin. But what followed wasn’t silence. It was a quiet revolution.

The 2021 Ban: Why Nigeria Tried to Shut Crypto Down

The CBN’s 2021 circular didn’t come out of nowhere. It built on a 2017 directive that already blocked Bitcoin transactions through banks. By 2021, Nigeria had become one of the world’s top users of cryptocurrency-not because of government support, but despite it. With inflation eating into the naira and foreign exchange shortages making dollars nearly impossible to get, Nigerians turned to crypto as a lifeline. P2P trading volumes exploded, making Nigeria the second-largest crypto trading hub globally, behind only the United States. The CBN claimed crypto was "opaque" and threatened the banking system. But the real issue? Cryptocurrency was bypassing their control. People were using USDT and Bitcoin to send money abroad, pay for imports, and save value. The central bank couldn’t track it. It couldn’t tax it. And worst of all, it couldn’t print more naira to fix the problem. So they banned banks from touching it. The plan? Make crypto disappear by cutting off its oxygen-banking access.The Underground Boom: How Nigerians Kept Trading

The ban didn’t kill crypto. It made it more resilient. Local exchanges like Paxful, Binance P2P, and local platforms shifted entirely to P2P. Users traded naira for USDT directly with other individuals, using mobile money apps, bank transfers, and even cash deposits. Banks didn’t know the money was for crypto-they just saw a transfer from Person A to Person B. The system worked because it didn’t need banks to be involved. By 2022, Nigeria accounted for over 20% of all African crypto trades. Over 30 million Nigerians owned digital assets, according to Chainalysis. The ban didn’t stop adoption-it just pushed it underground. And underground, it grew faster.The First Crack: Late 2022’s Quiet Policy Shift

By late 2022, things started changing-quietly. Banks began reopening accounts for crypto firms, but only under strict, unannounced conditions. No official statement. No press release. Just a slow thaw. Why? The economy was crumbling. Foreign reserves hit record lows. The naira was losing value daily. The government realized it couldn’t fight crypto-it needed to harness it. Crypto wasn’t just a threat. It was a workaround for foreign exchange shortages. Nigerians were using it to buy goods, pay for services, and even send remittances without waiting weeks for bank approvals. The CBN quietly allowed banks to process transactions for crypto firms that could prove they weren’t laundering money. No licensing yet. No rules. Just a test. And it worked.The Official Reversal: December 2023

On December 18, 2023, the new CBN Governor, Yemi Cardoso, officially lifted the 2021 ban. The announcement was short but powerful: banks could now legally serve cryptocurrency businesses-if they were licensed by the Securities and Exchange Commission (SEC). This wasn’t just a reversal. It was a full pivot-from prohibition to regulation. The CBN didn’t say crypto was safe. It said crypto was here, and it needed rules. The new rules were clear:- Banks can only work with crypto firms holding a valid SEC license as a Virtual Asset Service Provider (VASP).

- Crypto accounts must have transaction limits set by the bank-no unlimited trading.

- Cash withdrawals from crypto-linked accounts are banned. You can’t turn USDT into naira cash at an ATM.

- All transactions must follow AML and KYC rules.

The Legal Final Step: Investments and Securities Act (ISA) 2025

The real turning point came in March 2025, when Nigeria’s National Assembly passed the Investments and Securities Act (ISA) 2025. This law didn’t just tweak rules-it redefined crypto’s legal status. For the first time, digital assets were officially recognized as securities under Nigerian law. That means Bitcoin, Ethereum, and other tokens could now be treated like stocks or bonds-regulated, taxed, and protected under the same framework as traditional investments. The SEC became the main watchdog for crypto exchanges, requiring them to register as VASPs, submit quarterly reports, and prove they had robust security and fraud prevention systems. Non-compliant platforms could be shut down, fined, or prosecuted. This wasn’t just about crypto. It was about bringing Nigeria out of the Financial Action Task Force’s (FATF) Gray List. The country had been on that list since 2019 for weak anti-money laundering controls. Crypto was a big reason why. With ISA 2025, Nigeria now had a legal tool to track crypto flows-and prove it was serious about financial integrity.Who’s Getting Licensed? The Reality Check

The rules are set. But who’s actually getting approved? Yellow Card, a major African crypto platform, announced plans to apply for a Nigerian license and partnered with Coinbase to expand into 20 African countries. Other global players like Binance and Kraken are reportedly in talks. But insiders say the licensing process is slow-and selective. One crypto executive told Semafor Africa: "There aren’t going to be as many exchanges as I don’t think they’ll be giving so many licenses out." The SEC hasn’t published a timeline. No public application portal. No list of approved firms. That’s intentional. Regulators want to control the pace. They don’t want another crypto boom without oversight. As of November 2025, only three companies have publicly confirmed SEC licensing. Hundreds more are waiting.The Ongoing Tensions: Binance, Security, and the P2P Paradox

Even with the new rules, the government hasn’t fully embraced crypto. In March 2024, two Binance executives were detained by Nigerian authorities over allegations of untraceable fund flows. The case was dropped months later, but it sent a clear message: the state still sees crypto as a potential threat. By May 2024, Nigeria’s National Security Advisor reportedly considered labeling crypto trading a "national security threat"-a move that could have led to criminal penalties for P2P traders. That idea was shelved, but the fear remains. The biggest contradiction? The government wants banks to support licensed crypto firms-but 80% of Nigerian crypto users still trade via P2P because they can’t get bank accounts. The system is split: formal for big players, informal for everyone else.

What This Means for Nigerians Today

If you’re a Nigerian user in 2025, here’s what you face:- You can still buy crypto via P2P apps like Binance, Paxful, or local platforms.

- If you want to use your bank account for crypto, you need to go through a licensed exchange.

- You can’t withdraw crypto profits as cash from your bank.

- Large transfers (over 500,000 naira) may trigger AML checks.

- Investing in tokenized assets (like shares in crypto projects) is now legal-but only through SEC-approved platforms.

The Bigger Picture: Nigeria as a Model for Africa

Nigeria’s journey-from ban to regulation-is now studied by governments across Africa. South Africa, Kenya, Ghana, and Egypt are watching closely. If Nigeria’s system works, they’ll copy it. If it fails, they’ll stay cautious. The key lesson? You can’t ban decentralized technology. But you can regulate it. Nigeria didn’t win by fighting crypto. It won by accepting it-and putting rules around it. The next challenge? Making sure those rules work for everyday people, not just big companies.What’s Next? The Unanswered Questions

Three big questions still hang over Nigeria’s crypto future:- When will the SEC open the license application portal publicly?

- What are the exact transaction limits for crypto accounts?

- Will P2P trading be formally recognized-or remain in legal limbo?

Was cryptocurrency ever illegal to own in Nigeria?

No. Owning cryptocurrency was never illegal in Nigeria. The 2021 ban only blocked banks from processing crypto transactions. People could still buy, hold, and trade crypto using peer-to-peer platforms. The 2025 ISA law made crypto a regulated asset, but never criminalized ownership.

Can I use my Nigerian bank account to buy crypto today?

Yes-but only if you use a crypto exchange that has a valid license from the Securities and Exchange Commission (SEC). Banks are allowed to work with licensed Virtual Asset Service Providers (VASPs). If your exchange isn’t licensed, your bank will block the transaction.

Why can’t I withdraw crypto profits as cash from my bank?

The Central Bank of Nigeria prohibits cash withdrawals from crypto-linked accounts to prevent money laundering and reduce the risk of crypto being used to bypass foreign exchange controls. You can convert crypto to naira through a licensed exchange, but you can’t walk into a bank and withdraw it as physical cash.

Are Binance and Coinbase allowed to operate in Nigeria now?

Binance is not yet licensed by Nigeria’s SEC, though it continues to operate via P2P trading. Coinbase has not launched a direct service in Nigeria but is working with Yellow Card to enter the market. Only exchanges that have received formal SEC licensing as VASPs can legally offer banking services.

Is Nigeria’s crypto regulation helping the economy?

Yes, in key ways. By bringing crypto into the regulated system, Nigeria is improving its chances of being removed from the FATF Gray List, which helps attract foreign investment. It also gives people safer access to digital assets and reduces reliance on informal, unregulated markets. However, the slow pace of licensing and unclear rules are still holding back full economic benefits.

lol so nigeria just admitted crypto was too popular to kill? classic. banks freezing accounts and people still bought 20% of africa's crypto? that's not a ban, that's a marketing campaign for bitcoin. i'm surprised they didn't just print more naira and call it a day. 🤦♂️

The real story here isn't the ban or the reversal-it's the quiet resilience of people who refused to be controlled by broken systems. When institutions fail, communities adapt. Nigeria didn't 'win' by regulating crypto. It won because its people built an alternative economy without permission. That's the real revolution.

So they banned it then let it back in with red tape? Typical. You dont fix a broken system by slapping on compliance labels. You fix it by not being corrupt in the first place. Now they want to tax it? Great. More bureaucracy for people trying to survive

The regulatory framework is structurally inconsistent. The CBN permits licensed VASPs to interface with commercial banking infrastructure while prohibiting cash withdrawals from crypto-linked accounts, thereby creating a liquidity bottleneck that undermines the very purpose of digital asset adoption. This is not regulation-it's containment disguised as legitimacy.

It is, of course, profoundly ironic that a nation whose central bank has systematically eroded the purchasing power of its fiat currency through unchecked monetary expansion now seeks to impose AML/KYC compliance on a decentralized, pseudonymous asset class-while simultaneously refusing to permit cash redemption, thereby ensuring that the only beneficiaries of this regulatory architecture are institutional intermediaries with the capital to navigate the labyrinthine licensing process. The hypocrisy is not merely systemic-it is existential.

Nigeria did what no western country had the guts to do-face reality. You think America would let its people bypass the Fed? Please. We don't need your sanctions or your lectures. We built our own system while you were debating crypto taxes. This isn't chaos-it's competence. The world is watching, and we're not apologizing.

The P2P paradox is the most telling part: regulation is designed for institutions, but adoption thrives in the informal. The state wants to control the flow, yet the flow was never meant to be controlled. The real question isn't whether the SEC will issue more licenses-it's whether the people will still trust a system that demands compliance but denies access. Trust, after all, isn't regulated. It's earned.

Honestly? This is one of the most hopeful stories in global finance right now. People didn't wait for permission. They just built something better with what they had. The government eventually caught up-not because they were smart, but because they had no choice. That’s how real change happens.

I'm so proud of Nigerian people for turning a ban into a movement. 💙 You didn't ask for permission-you just kept going. And now the world has to take notice. This isn't just about crypto. It's about dignity. Thank you for showing us what resilience looks like.

So you're telling me people were trading crypto while their currency collapsed... and now the government wants to 'regulate' it? That's not progress. That's a power grab. You think these 'licensed' exchanges are any less sketchy? They're just the ones with lawyers.

The evolution from prohibition to regulated asset class represents a paradigmatic shift in sovereign monetary policy. Nigeria’s approach-though imperfect-demonstrates a rare instance of adaptive governance in the face of decentralized technological disruption. The continued exclusion of P2P from formal recognition, however, introduces a structural asymmetry that may ultimately undermine regulatory credibility and foster continued informal market proliferation.

Let’s be real: the SEC isn’t licensing exchanges-they’re licensing corporate partners. The 3 approved firms? All have deep ties to global VC firms. Meanwhile, local devs who built P2P apps from their bedrooms? Still in the shadows. This isn’t inclusion. It’s consolidation dressed in compliance.

P2P still rules. The rest is theater.