Nigeria doesn’t have a list of banned crypto exchanges like a blacklist you can print out. Instead, it has a licensing system-and if you’re not licensed, you’re effectively banned. That’s the reality as of 2025. The country moved away from outright prohibition and now operates under the Investments and Securities Act (ISA) 2025, which gives the Securities and Exchange Commission (SEC) the power to approve or shut down crypto platforms. So, the question isn’t ‘which exchanges are banned?’-it’s ‘which ones are allowed?’

There Are No Official Bans, Only Unlicensed Exchanges

You won’t find a government document saying ‘Binance is banned.’ But you’ll find that Binance can’t process Naira deposits or withdrawals anymore. In February 2024, the platform stopped Naira trading on its peer-to-peer service. Nigerian telecom providers started blocking access to Binance’s website. That doesn’t mean you can’t use it. You still can. You can log in, send Bitcoin to your wallet, or trade BTC for ETH. But if you want to buy crypto with Naira or cash out to your bank account, you’re blocked. That’s not a ban-it’s a restriction. And it’s the same for most international exchanges that haven’t applied for or received a Nigerian license.Only Two Exchanges Are Officially Licensed (As of 2025)

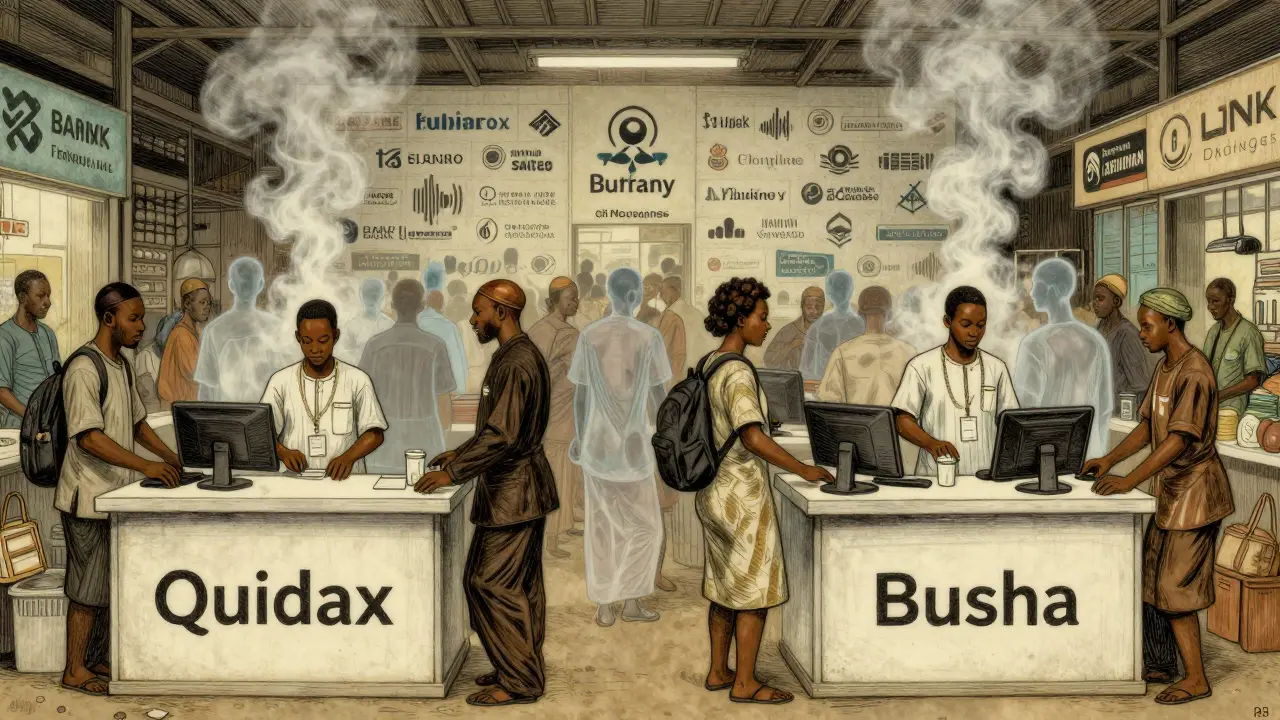

Right now, only two crypto exchanges have the green light from Nigeria’s SEC: Quidax and Busha. These are Nigerian-based platforms that went through a long, strict licensing process. They had to prove they could handle KYC checks, anti-money laundering controls, transaction monitoring, and customer dispute resolution. They also had to show they had enough financial backing and technical infrastructure to meet regulatory standards. These two platforms are now the only ones legally allowed to offer Naira-to-crypto trading. That means if you want to buy Bitcoin with your Nigerian bank account without using a VPN or third-party middleman, Quidax and Busha are your only two legal options. They’ve built customer service teams, local support lines, and even mobile apps designed for Nigerian users. Many users report faster withdrawals and better help than they got from international platforms.Binance Is Not Banned-It’s Just Not Licensed

Binance is the biggest name people think of when they ask about bans. But here’s the truth: Binance still operates in Nigeria. Nigerian users still hold Binance accounts. They still trade crypto-to-crypto. They still withdraw Bitcoin or Ethereum to external wallets. What they can’t do is deposit Naira directly or withdraw to a Nigerian bank. The platform’s domain is blocked by local ISPs, so most users need a VPN to access it. But the SEC hasn’t ordered Binance to shut down completely. It just hasn’t approved it. That’s the difference between a ban and non-compliance. Binance hasn’t applied for a license, or if it did, it hasn’t passed the SEC’s review. Until it does, it won’t be allowed to handle Naira. But it’s not illegal to use. Many Nigerians still do-especially those who trade crypto as an asset class rather than a currency.

Why the Shift from Ban to Licensing?

Back in 2021, the Central Bank of Nigeria (CBN) told banks to stop serving crypto businesses. That led to chaos. People used P2P platforms, foreign wallets, and informal networks to keep trading. By 2023, the CBN reversed course. It realized that banning crypto didn’t stop it-it just drove it underground. Nigeria was already one of the world’s top crypto markets, with over $92 billion in crypto value flowing in between July 2024 and June 2025. That’s more than South Africa, Ghana, and Kenya combined. The government realized it couldn’t stop the tide. So it decided to regulate it. The ISA 2025 made digital assets legally recognized as securities. It gave the SEC authority to license platforms, fine non-compliant ones, and even access telecom data to track fraud. It also created new tax rules under the Nigeria Tax Administration Act (NTAA) 2025, which kicks in 2026. Unlicensed VASPs (Virtual Asset Service Providers) could face fines of ₦10 million ($6,693) in the first month of violation, plus ₦1 million ($669) every month after.What Happens to Unlicensed Exchanges?

If an exchange isn’t licensed, the SEC doesn’t need to issue a public ban. They just cut off its access. Banks can’t process payments to or from unlicensed platforms. Telecom companies block their domains. Payment processors refuse to work with them. That’s how enforcement works now-indirect, but effective. Many smaller international exchanges that never bothered applying for a Nigerian license are now invisible to the average Nigerian user. You won’t find them on Google searches. You won’t see ads for them on social media. They’re not listed on local crypto forums anymore. The market has cleaned itself up. Only licensed players can advertise. Only licensed players can partner with Nigerian fintechs. Only licensed players can get payment integration with local banks.Workarounds Still Exist-But They’re Risky

Some users still use VPNs to access Binance, Kraken, or Coinbase. Some use P2P platforms like Paxful or LocalBitcoins to trade with individuals. Others use crypto-friendly banks in neighboring countries. But these methods aren’t protected by law. If you’re scammed on an unlicensed platform, there’s no regulator to turn to. No customer support line. No legal recourse. The SEC doesn’t investigate fraud on unlicensed platforms. Licensed exchanges like Quidax and Busha, on the other hand, are required to have dispute resolution systems. If your deposit doesn’t show up, they must investigate. If your account gets hacked, they must have insurance or compensation plans. That’s the real value of licensing-it’s not about control. It’s about safety.

The Future: More Licensed Exchanges Coming

The SEC is reviewing dozens of license applications. Several international exchanges, including some from the U.S. and Europe, are reportedly preparing to apply. The licensing process takes 6 to 12 months. It’s expensive. It’s complex. But the payoff is big: access to Nigeria’s 200+ million people and one of the fastest-growing crypto markets in the world. Experts predict at least five more licensed exchanges will be approved by the end of 2026. Some may be local startups. Others could be global platforms that decide it’s worth the cost to play by Nigerian rules. The market is moving toward legitimacy. The days of shady, offshore exchanges operating in the shadows are ending.What Should Nigerian Crypto Users Do?

If you want to trade crypto legally and safely in Nigeria, stick to Quidax and Busha. They’re the only two with SEC approval. If you want to use Binance or another international platform, understand the risks: no Naira deposits, no bank withdrawals, no legal protection, and potential domain blocking. Use a VPN if you must-but know you’re operating outside the law. Don’t assume that because a platform is popular, it’s safe. Don’t trust forums or Telegram groups that recommend ‘the best exchange.’ Only trust what’s listed on the SEC’s official website. And remember: if it’s not licensed, it’s not protected.What’s Next for Nigeria’s Crypto Market?

The next big changes will come with the NTAA 2025 tax rules, which will require exchanges to report user transactions and withhold taxes. That means even licensed platforms will need to upgrade their systems. DeFi protocols, stablecoins, and NFTs are also on the SEC’s radar. More rules are coming. But the direction is clear: Nigeria isn’t turning away from crypto. It’s bringing it into the light. The country is betting that regulation will attract investment, not scare it away. And so far, the numbers prove it’s working. Nigeria didn’t ban crypto. It outgrew the need to.Are any crypto exchanges completely banned in Nigeria?

No exchange is officially banned by name. Instead, only two exchanges-Quidax and Busha-are currently licensed to operate with Naira. All others are effectively blocked from Naira transactions and domain access if they haven’t applied for or received a license from the SEC. This means they can’t legally process deposits or withdrawals in Nigerian currency, but users can still access them via VPN for crypto-to-crypto trading.

Is Binance banned in Nigeria?

Binance is not officially banned, but it is not licensed. As of 2025, Binance no longer supports Naira deposits or withdrawals, and its website is blocked by Nigerian ISPs. Users can still access Binance via VPN to trade crypto-to-crypto and withdraw funds to external wallets, but they cannot use it as a direct gateway to the Nigerian banking system. The SEC has not shut down Binance-it simply hasn’t approved it for local operations.

Which crypto exchanges are legal in Nigeria?

As of 2025, only two crypto exchanges are legally licensed to operate with Naira in Nigeria: Quidax and Busha. Both are Nigerian-based platforms that have met the Securities and Exchange Commission’s strict requirements for KYC, AML, transaction monitoring, and customer protection. Any other exchange offering Naira trading is operating without legal authorization.

Can I still use Binance or Coinbase in Nigeria?

Yes, but only for crypto-to-crypto trades and withdrawals to external wallets. You cannot deposit or withdraw Naira through these platforms. Accessing them requires a VPN because their domains are blocked by Nigerian telecom providers. Using them this way is technically possible but carries legal and financial risks-you won’t have access to Nigerian consumer protections, and you’re operating outside the regulated system.

Why did Nigeria stop banning crypto and start licensing exchanges?

Nigeria stopped banning crypto because it realized prohibition didn’t work. Despite a 2021 banking ban, Nigerians continued trading crypto, with over $92 billion flowing into the country between July 2024 and June 2025. The government shifted to licensing to bring the market into the open, protect users, collect taxes, and prevent fraud. The ISA 2025 gave regulators the tools to monitor activity and punish illegal operators, making the system safer and more sustainable.

What happens if I use an unlicensed crypto exchange in Nigeria?

If you use an unlicensed exchange, you’re not breaking the law by simply holding crypto-but you’re at risk. You won’t have legal recourse if you’re scammed, your funds are stolen, or your deposit disappears. The SEC doesn’t investigate fraud on unlicensed platforms. You also won’t be able to withdraw to your Nigerian bank account. While using a VPN to access these platforms is common, it operates in a legal gray zone with no protection.

Will more crypto exchanges get licensed in Nigeria?

Yes. The SEC is currently reviewing dozens of applications from both local and international exchanges. The licensing process is slow and expensive, requiring strong compliance systems, but the potential market is huge. Experts expect at least five more licensed exchanges to launch by the end of 2026. The trend is clear: Nigeria wants regulated, transparent crypto platforms-not underground ones.

Are there any tax implications for using crypto in Nigeria?

Yes. The Nigeria Tax Administration Act (NTAA) 2025, effective in 2026, will require licensed exchanges to report user transactions and withhold taxes on crypto gains. Even if you use an unlicensed platform, you’re still legally required to report crypto income to the Federal Inland Revenue Service (FIRS). Failure to do so could lead to penalties, especially as the government improves its ability to track transactions through telecom and banking data.

So let me get this straight-Nigeria didn't ban crypto, they just made it impossible for unlicensed platforms to touch Naira? That's not regulation, that's a velvet guillotine. Binance's P2P got nuked but you can still trade BTC for ETH? Sounds like they're forcing everyone into Quidax and Busha like it's a state-sponsored monopoly. I'm not mad, I'm just disappointed.

The shift from prohibition to licensing reflects a mature understanding of market dynamics. When a behavior becomes too pervasive to suppress, governance evolves to channel it rather than combat it. The ISA 2025 represents a pragmatic alignment with economic reality, not a surrender. The real test will be enforcement consistency and transparency in licensing criteria.

I live in the US and I still use Binance via VPN for crypto-to-crypto. But I get it-Nigeria’s move makes sense. No one wants their people getting scammed by some offshore sketchy site with no recourse. Quidax and Busha might be the only options now, but at least if your deposit vanishes, you can actually call someone. That’s huge.

Nigeria finally got smart. 🇳🇬 We don't need foreign exchanges playing with our currency. Quidax and Busha are ours. They understand our problems. No more waiting 3 days for withdrawals. No more fake customer service bots. This is African innovation. No VPN needed. Just real service.

The fact that telecoms are blocking domains is the real story here. That's not regulation that's infrastructure control. The SEC doesn't need to ban anything if they can just cut off the pipes. Smart. But also kind of terrifying if you think about it.

If you're using Binance right now in Nigeria, you're basically gambling with your money. No protection, no help, no recourse. Just hope you don't get hacked or scammed. Quidax and Busha might not be flashy but they're the only ones keeping your cash safe. Trust the system, not the hype.

Wait so if I use a vpn to get to binance and trade btc for eth im not breaking any laws? but if i try to deposit naira im in trouble? that sounds like a loophole big enough to drive a truck through. also why is no one talking about the tax thing in 2026??

Honestly i think this is the best thing that couldve happened. Before everyone was just using p2p and getting ripped off all the time. Now at least we have real support and insurance. Quidax saved me when my deposit got stuck. Took 2 days but they fixed it. Blessings to the sec for finally doing something right.

I used to be super pro-Binance. But after I lost a week’s salary because a P2P seller disappeared, I switched to Quidax. No more stress. No more guessing. Just a simple app that works. I get SMS alerts. My withdrawals hit my bank in 20 minutes. It’s not sexy, but it’s reliable. That’s what matters.

This isn't regulation. This is economic colonization dressed up in compliance paperwork. They're turning Nigeria into a crypto theme park where only two local vendors get to sell cotton candy while the rest of the world gets locked out. The SEC isn't protecting users-they're protecting their own cronies.

Let’s be real-this is the only way forward. You can’t have a $92B market operating in the dark. Licensed exchanges mean KYC, insurance, dispute resolution, and tax compliance. Yes, it’s a barrier. Yes, it’s frustrating. But if you want to protect your money, you don’t want the Wild West. You want a bank with blockchain. Quidax and Busha are the future. The rest are ghosts.

The government has no right to dictate which platforms Nigerians may use. This is socialism with a crypto veneer. If Binance wants to operate here, let them. If users want to use them, let them. This is not about safety-it’s about control. And control always leads to corruption. The SEC will become a rent-seeking machine.

I don't care if it's licensed or not. If I can't use my preferred exchange, I'll find a way. VPNs aren't hard. P2P is alive. Crypto isn't about convenience-it's about freedom. Licensing is just a fancy word for gatekeeping.

One must admire the bureaucratic elegance of this approach. By leveraging third-party infrastructure-telecoms, banks, payment processors-the regulator achieves de facto prohibition without the political fallout of an explicit ban. A masterclass in regulatory minimalism. One wonders if this model will be exported to other emerging markets.

This is actually a brilliant middle ground. Not everyone can be a crypto expert, and most people don't know the difference between a legitimate exchange and a scam. By forcing platforms to comply with real standards, Nigeria is creating a safer ecosystem. The fact that users still have access to global platforms via VPN? That’s freedom with responsibility. Well done.