Crypto Green Score Calculator

Evaluate cryptocurrencies based on environmental credentials and transparency

How it works

This calculator helps you identify genuine eco-friendly cryptocurrencies by evaluating critical criteria:

- Transparency of technology

- Verified energy usage data

- Environmental certifications

- Developer community activity

- Real-world applications

Result

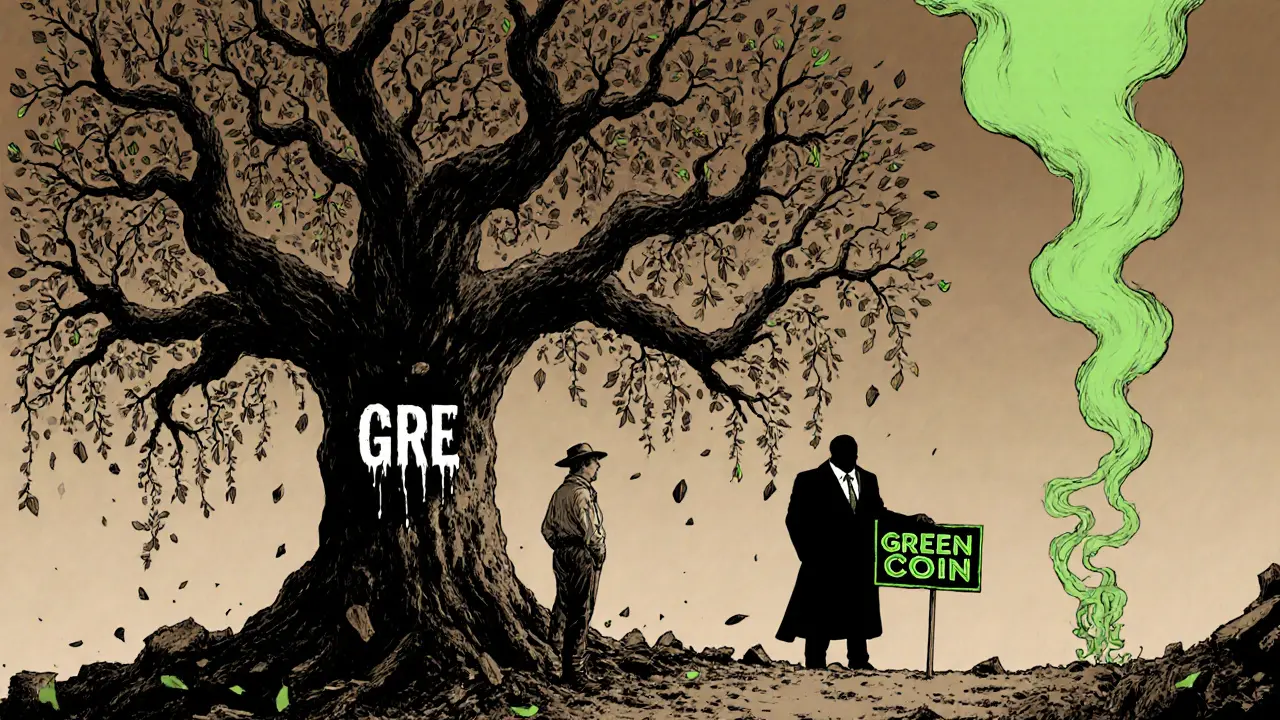

Example: GREEN (GRE) Cryptocurrency

GREEN (GRE) Evaluation

Score: 17/100

This cryptocurrency failed all key environmental verification criteria:

- No whitepaper or technical documentation

- No public energy usage data

- No environmental certifications

- Listing only on obscure exchanges

- No active developer community

- No real-world applications

RED FLAG The price crashed 98% in 24 hours due to lack of liquidity and trust. This is a clear indicator of a project with no real foundation.

When you hear the word GREEN in crypto, you might think of something clean, sustainable, and future-proof-like a blockchain that actually helps the planet. But the reality of GREEN (ticker: GRE), also known as Greencoin, is far from that promise. This isn’t just another altcoin with a green name. It’s a project with no verifiable tech, no transparent supply, and a price that just crashed 98% in a single day. If you’re wondering whether GREEN is a legitimate eco-friendly crypto or just another ghost project, the answer isn’t complicated: it’s dangerously close to a scam.

What is GREEN (GRE) actually supposed to be?

GREEN, or Greencoin, claims to be a cryptocurrency built for sustainability. Its website, grcoin.com, says it’s designed to reduce the environmental damage caused by Bitcoin-style mining. But here’s the problem: there’s no proof. No whitepaper. No technical documentation. No GitHub repo. No developer community. No energy usage metrics. None of the things that real blockchain projects publish to prove they’re doing what they say. Compare that to Cardano, which uses a Proof-of-Stake system proven to use 99.9% less energy than Bitcoin. Or Hedera, which processes transactions at 0.00017 kWh per transaction and is certified carbon-negative. Those projects have public data, third-party audits, and developer tools. GREEN has a website that looks like it was built in 2017 and a Twitter account with no followers.The numbers don’t add up-here’s why

CoinMarketCap lists GREEN’s total supply as over 4 billion tokens. But it also says the circulating supply is zero. That’s not a glitch. That’s a red flag. If no tokens are circulating, how are people trading it? The answer: they’re not, not really. The few trades that show up are on two tiny Korean exchanges with almost no volume. One user on Reddit said they tried to use the official wallet and the site wouldn’t load. The support email bounced back. Then there’s the price. On October 23, 2025, GREEN dropped 98.11% in 24 hours. That kind of crash doesn’t happen because of market trends. It happens when there’s no liquidity, no demand, and no trust. When a coin’s value can vanish overnight because no one’s buying, it’s not a currency-it’s a gamble with no odds.Why no one in the industry takes it seriously

The crypto world has standards now. The Crypto Climate Accord has over 200 members, including Ripple and ConsenSys. They’re all committed to using 100% renewable energy by 2025. GREEN isn’t on that list. The EU’s MiCA regulation now certifies blockchains for ESG compliance. GREEN isn’t certified. S&P’s crypto sustainability index includes 15 verified green blockchains. GREEN isn’t one of them. Even the people who study crypto energy use are warning against projects like this. Alex de Vries, founder of Digiconomist, says: “Blockchains claiming green credentials without transparent energy metrics are red flags for investors.” That’s exactly what GREEN is-a claim without proof.

How does it compare to real green cryptocurrencies?

| Feature | GREEN (GRE) | Cardano (ADA) | Hedera (HBAR) | Algorand (ALGO) |

|---|---|---|---|---|

| Consensus Algorithm | Unknown | Proof-of-Stake | Hashgraph (PoS-like) | Pure Proof-of-Stake |

| Energy per Transaction | Not disclosed | 0.0006 kWh | 0.00017 kWh | 0.0002 kWh |

| Market Cap (Oct 2025) | $0.8M (unverified) | $14.2B | $4.7B | $3.1B |

| Circulating Supply | Reported 0 | 34.5B | 36.2B | 13.6B |

| Developer Tools | None | Full SDKs, testnets | 8,500+ devs, SDKs | Algorand Academy, 15K+ certified devs |

| Carbon Verification | No | Yes (via ClimateTrade) | Yes (carbon-negative) | Yes (real-time tracking) |

| Exchange Listings | 2 obscure Korean exchanges | Binance, Coinbase, Kraken | Binance, Kraken, OKX | Binance, Coinbase, KuCoin |

The real danger: fake sustainability

GREEN isn’t just useless-it’s harmful. It preys on people who care about the environment and want to invest responsibly. It uses the word “green” to make you feel good, while offering nothing but empty promises. That’s not innovation. That’s greenwashing. Real eco-friendly crypto projects don’t just say they’re green. They show it. They publish their energy numbers. They get audited. They partner with environmental groups. They build tools for developers. GREEN does none of that.

What should you do if you own GREEN?

If you bought GREEN because you thought it was helping the planet, you’re not alone. But now you know the truth. The coin has no value, no support, and no future. The smartest move isn’t to wait for a rebound-it’s to cut your losses and move on. Don’t chase it. Don’t try to “HODL” it. Don’t believe the few posts online saying “it’s going to 10x.” Those are bots or shill accounts. There’s no community behind it. No team. No roadmap. No transparency. Just a ticker symbol and a broken website.What are the real alternatives?

If you want to invest in crypto that actually helps the planet, look at these:- Cardano (ADA) - Uses proof-of-stake, low energy, strong ecosystem funding

- Hedera (HBAR) - Most energy-efficient blockchain, carbon-negative, used by major enterprises

- Algorand (ALGO) - Pure proof-of-stake, real-time carbon tracking, integrates with ClimateTrade

- Solana (SOL) - Fast, low-energy, partnered with WWF for carbon credit tracking

- Energy Web Chain (EWT) - Built for utilities and energy companies, verified renewable energy use

Final verdict: Is GREEN worth anything?

No. Not now. Not ever. Not unless the entire project is rebuilt from scratch-with transparency, accountability, and real engineering. Right now, it’s a ghost coin. A digital mirage. A warning sign. The crypto space is full of scams. But GREEN isn’t just a scam-it’s a scam dressed up as a solution. And that’s the most dangerous kind.Is GREEN (GRE) a real cryptocurrency?

Technically, yes-it exists as a token on some obscure exchanges. But it lacks the core features of a real cryptocurrency: transparent technology, verifiable energy use, developer tools, and community support. Without these, it’s just a digital asset with no foundation.

Why did GREEN’s price crash 98%?

The crash happened because there was no real demand or liquidity. Only a handful of trades occurred on two tiny exchanges. When the last buyers pulled out, the price collapsed. This is typical of coins with no backing, no team, and no use case.

Can I mine or stake GREEN?

No. There’s no public information about how GREEN works. No staking wallets, no mining software, no consensus algorithm disclosed. You can’t stake it because no one knows how to stake it.

Is GREEN listed on Binance or Coinbase?

No. GREEN is not listed on any major exchange. It only appears on two low-volume Korean platforms with minimal trading activity. Major exchanges like Binance and Coinbase have strict listing criteria, and GREEN fails every one of them.

Does GREEN have a whitepaper or technical documentation?

No. The project’s website, grcoin.com, offers no whitepaper, no technical specs, no code repository, and no developer resources. This level of opacity is a major red flag in crypto, where transparency is the baseline for trust.

Is GREEN environmentally friendly?

There is no evidence to support this claim. Unlike verified green blockchains like Cardano or Hedera, GREEN provides zero data on energy usage, carbon emissions, or sustainability certifications. Claims of being “eco-friendly” without proof are misleading and match the definition of greenwashing.

Should I invest in GREEN?

Absolutely not. With no transparency, no liquidity, no team, and no utility, GREEN is a high-risk, zero-reward asset. The 98% price drop isn’t a dip-it’s a collapse. Investing in it is gambling with no odds, not crypto investing.

What should I do if I already own GREEN?

If you own GREEN, the best action is to sell it-no matter how little you get back. Holding it won’t make it valuable. There’s no roadmap, no development, and no community to support a rebound. Accept the loss and move your funds to a verified, transparent cryptocurrency with real environmental credentials.

GREEN is a scam. Period. I saw this coming from a mile away. Zero transparency, zero liquidity, zero future. People are still buying it? 😑

If you're looking for real eco-friendly crypto, stick with Cardano, Hedera, or Algorand. They publish their energy metrics, have developer ecosystems, and are listed on major exchanges. GREEN has none of that. Don't confuse marketing with substance.

Oh wow. Another ‘green’ coin that’s just a shell. The irony is thick enough to choke on. They slap ‘sustainable’ on a project with no code, no team, and no proof - then wonder why it crashes. Greenwashing isn’t innovation, it’s theft. And it’s stealing from people who actually care about the planet.

Cardano uses less energy than your toaster. Hedera’s carbon-negative. Algorand tracks emissions in real time. GREEN? It’s a website built on Wix with a fake Twitter account. The fact that anyone still thinks this is legit is terrifying.

This isn’t crypto. This is a carnival ride with no safety rails. People lose money, then blame the market. But the market didn’t lie - the project did. And now it’s gone. Poof. Like it never existed. Which, honestly, it shouldn’t have.

Why do people fall for this? Because they want to believe. They want to think their investments are doing good. But you don’t save the planet by buying a ticker symbol with zero documentation. You do it by supporting projects that prove their claims.

And if you’re still holding GREEN? Stop. Just stop. Selling at a loss is better than pretending it’ll bounce back. There’s no community. No devs. No roadmap. Just a ghost in a digital graveyard.

Real green crypto doesn’t need hype. It doesn’t need TikTok influencers. It just needs transparency. And GREEN? It’s got none.

The next time someone says ‘green coin,’ ask for the whitepaper. Ask for the energy numbers. Ask for the GitHub. If they can’t answer, walk away. This isn’t investing. It’s gambling with a conscience.

And if you’re one of the few who still believes in this? You’re not just losing money. You’re validating fraud. That’s the real cost.

It’s sad how often projects like this prey on people who want to do good. I’ve seen so many investors get burned by ‘eco-friendly’ tokens that turn out to be smoke and mirrors. The worst part? They feel guilty for even considering it - like they failed the planet. But really, the fraudsters failed them.

Green crypto can be real. But it needs accountability. And GREEN? It’s the opposite.

Man I feel for anyone who bought this thinking it was helping the earth. I come from South Africa where people are desperate for real solutions to climate change. Fake green projects just make it harder for the real ones to get trust. Please don't fall for this kind of stuff

Green = greenwashing. 😅

Anyone still holding GREEN is just chasing ghosts. Sell. Move on. There are better options out there that actually do what they say

I understand the allure - the idea of supporting a cryptocurrency that’s genuinely sustainable, that aligns with our values, that doesn’t contribute to the climate crisis - but when a project makes grand claims without offering any verifiable data, without providing transparency around its technology, without even disclosing its energy consumption metrics, it’s not just irresponsible - it’s fundamentally dishonest. And when you combine that with a complete absence of developer activity, no whitepaper, no GitHub, no community, no exchange listings beyond two obscure Korean platforms - it becomes clear that this isn’t a project that failed - it was never a project at all. It was a trap, dressed in green, designed to exploit the hope of well-intentioned people who want to believe in something better. And that, more than anything, is what makes it so dangerous.

Real eco-friendly blockchains like Cardano, Hedera, and Algorand don’t just say they’re green - they prove it. They publish audits. They partner with environmental organizations. They optimize for energy efficiency from the ground up. They have teams of engineers, public roadmaps, and active developer forums. GREEN has none of that. Not even a single line of code. Not a single public commitment. Just a website and a ticker symbol.

And now, after a 98% crash, it’s clear: this was never about sustainability. It was about extraction. It was about taking money from people who care, and leaving them with nothing but a broken wallet and a broken trust. That’s not innovation. That’s predation.

If you own this, please, for your own sake - and for the sake of the movement toward real green crypto - sell it. Don’t wait for a miracle. There won’t be one. The only thing that will rebound is your peace of mind when you finally let go.

And to everyone who still believes in the promise of sustainable blockchain - don’t give up. Just be smarter. Demand proof. Demand transparency. Demand accountability. Because if we stop rewarding fraud, we’ll make space for the real solutions to grow.

It's funny how we're all so quick to call things scams when they crash... but never ask why they rose in the first place. Who was pumping this? Who had the early supply? And why does no one talk about that? There's a story behind the crash - and it's not just about greed. It's about control. Who owned the tokens? Who sold them first? Who knew this was a house of cards?

Greenwashing? Maybe. But what if it's more than that? What if this was a honeypot - designed to lure in the idealistic, the environmentally conscious, the ones who trust the narrative? And then... poof. All the liquidity vanishes. The devs disappear. The website goes dark. And the only people left holding it are the ones who believed the dream.

It's not just a scam. It's a psychological experiment. And we're all the subjects.

Wait - did you know the same people who ran GREEN also launched ‘BLUE’ and ‘PURPLE’? All the same website template. All the same ‘green’ buzzwords. All the same 98% crashes. I’ve been tracking this since 2023. They switch names every time they get caught. They’re not even trying anymore. They’re just harvesting wallets like crops. And the worst part? The same people keep falling for it. Every. Single. Time.

They’re not crypto devs. They’re con artists with Canva accounts.

It’s pathetic how Americans still fall for this nonsense. We have real innovations in clean energy tech - and instead, people chase tokens with no code and no team. This isn’t crypto. It’s a national embarrassment. The world watches us and thinks we’re all gullible fools. And we are. We are.

GREEN? More like GREED. I mean come on - no whitepaper? No devs? Zero circulating supply? That’s not a coin, that’s a phishing link with a logo. Why are we even debating this? It’s obvious. Stop wasting time.

I’ve seen this pattern too many times. People get excited about ‘green crypto’ because they want to feel like they’re doing good. But real change doesn’t come from buying tokens. It comes from supporting real projects with real teams, real audits, real impact. GREEN didn’t fail because the market turned - it failed because it was never real to begin with. The lesson isn’t about crypto. It’s about trust. Always ask: who’s behind this? What’s the proof? And why should I believe them?

From India we have so many young people jumping into crypto hoping to make a difference. Projects like GREEN make it harder for real sustainable projects to get noticed. People get burned and then lose faith in the whole idea of green tech. It’s a shame. We need more transparency not less. I hope this post helps someone avoid this trap

It’s not just about money - it’s about values. When someone uses the word ‘green’ to sell something that harms trust, they’re not just scamming investors. They’re poisoning the idea of sustainability itself. We need to protect the meaning of ‘eco-friendly’ - not let it become a marketing buzzword for fraud. Thank you for exposing this.

Did you know the domain grcoin.com was registered under a shell company in the Caymans? And the ‘founder’ listed on the site? He’s a known crypto exit-scammer from 2021. They just reused his identity. This isn’t a coin. It’s a rerun of the same scam with a new name. They’ve done this 7 times now. The SEC knows. They just don’t care until enough people cry.

Just sold my last 0.02 GRE. Felt like flushing money down the toilet... but at least I didn’t keep hoping. 🤷♂️

Same. I bought it thinking it was a hidden gem. Turns out it was just a gem... in a landfill. 😅